Pitcairn Family Office Enters RIA Market with Brightside Partners Acquisition

In a meaningful strategic move,Pitcairn Family Office has officially entered the registered investment advisor (RIA) sector by acquiring Brightside Partners. This collaboration aims to elevate Pitcairn’s wealth management services while expanding its offerings for high-net-worth clients. As family offices adapt to a rapidly changing financial surroundings, this acquisition underscores Pitcairn’s commitment to innovation and growth in a complex market landscape.The partnership seeks to leverage Brightside’s investment management expertise, establishing a robust foundation for both organizations as they navigate evolving market conditions.This merger reflects a broader trend among family offices pursuing diverse operational strategies to fulfill their clients’ financial needs.

Pitcairn’s Strategic Entry into the RIA Market

Pitcairn has made a bold move towards diversifying its portfolio through the acquisition of Brightside Partners, marking its entry into the Registered Investment Advisor (RIA) arena. This strategic decision aligns with Pitcairn’s objective of enhancing client services via innovative investment strategies and extensive wealth management expertise provided by Brightside.By integrating these new capabilities, Pitcairn is well-positioned to deliver customized financial advice that caters to the dynamic requirements of its clientele.

The partnership is anticipated to bring several advantages, including:

- Diverse Service Offerings: Clients will benefit from an expanded range of financial solutions.

- Enhanced Knowledge Base: The combined expertise will enrich investment methodologies.

- Sustained Growth Opportunities: The acquisition positions Pitcairn for long-term success within an increasingly competitive marketplace.

| Metric | Before Acquisition | After Acquisition |

|---|---|---|

| Total Assets Under Management (AUM) | $2 billion | $2.5 billion |

| Total Client Count |

The Changing RIA Landscape: Implications for Family Offices and Wealth Management Firms

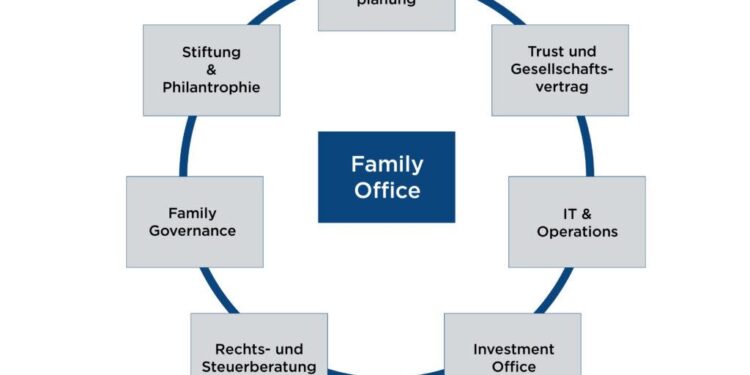

Pitcairn’s recent venture into the registered investment advisor domain through its acquisition of Brightside Partners marks an crucial transformation within family offices and wealth management firms alike. As these entities increasingly recognize the advantages of creating their own RIA platforms, they are better equipped to provide tailored investment strategies that align with their clients’ distinct values and goals. This shift allows family offices greater control over their investments while fostering improved client relationships and operational efficiencies.

This transition occurs amid broader industry changes where family offices are evolving from mere custodians of wealth into proactive advisors within finance sectors. Key implications include:

- Bespoke Investment Solutions: Family offices can craft personalized strategies that closely align with individual familial objectives.

- Navigating Regulatory Frameworks: Adapting compliance measures will be crucial as families embrace RIA responsibilities.

- < strong > Competitive Edge: By establishing their own RIAs ,familyoffices can differentiate themselves in an increasingly saturated marketplace .

< / ul >The trend toward more family offices entering the RIA space suggests that collaborations with established advisory firms may become more common . These partnerships can facilitate knowledge sharing ,operational support ,and enhanced service delivery . Table 1 outlines potential collaborative structures :

Partnership Type Description

< / tr >

< /thead >< td >Complete Integration Family office merges fully with an existing RIA. < tr >< td >Strategic Partnership Collaboration on shared services while maintaining self-reliant operations. < tr >< td >Sub-Advisory Arrangement RIAs provide specialized expertise while family office oversees overall strategy. < /tbody >

< /table >

Success Strategies: Recommendations for Family Offices Entering the RIA Space

The transition of family offices like Pitcairn into Registered Investment Advisors necessitates adopting robust strategies aimed at ensuring sustainability amidst ongoing changes in finance dynamics.To effectively manage this integration process, here are several recommendations for consideration:

- {

- < strong > Embrace Technology : (Utilizing advanced fintech solutions can streamline operations while enhancing client interactions.)

- < strong>Diversify Asset Classes : Expanding investments across various asset types such as real estate or private equity helps mitigate risks associated with market fluctuations .

- < strong>Add Compliance Measures : Proactive compliance protocols safeguard against regulatory shifts while building trust among clients .

- < strong>Create Talent Progress Programs : Investing in skilled professionals alongside innovative thinkers fosters growth opportunities leading towards superior service delivery .

Moreover , forging alliances within established networks provides invaluable insights alongwith operational efficiencies . Engaging educational initiatives like workshops or training sessions strengthens staff capabilities contributing towards continuous advancement culture . In lightof shifting landscapes ahead ,these approaches remain vitalfor securing competitive advantages moving forward .