Marshall Islands Eye Reform: IMF Technical Assistance Report Proposes Key Changes to Consumption and Income Tax systems

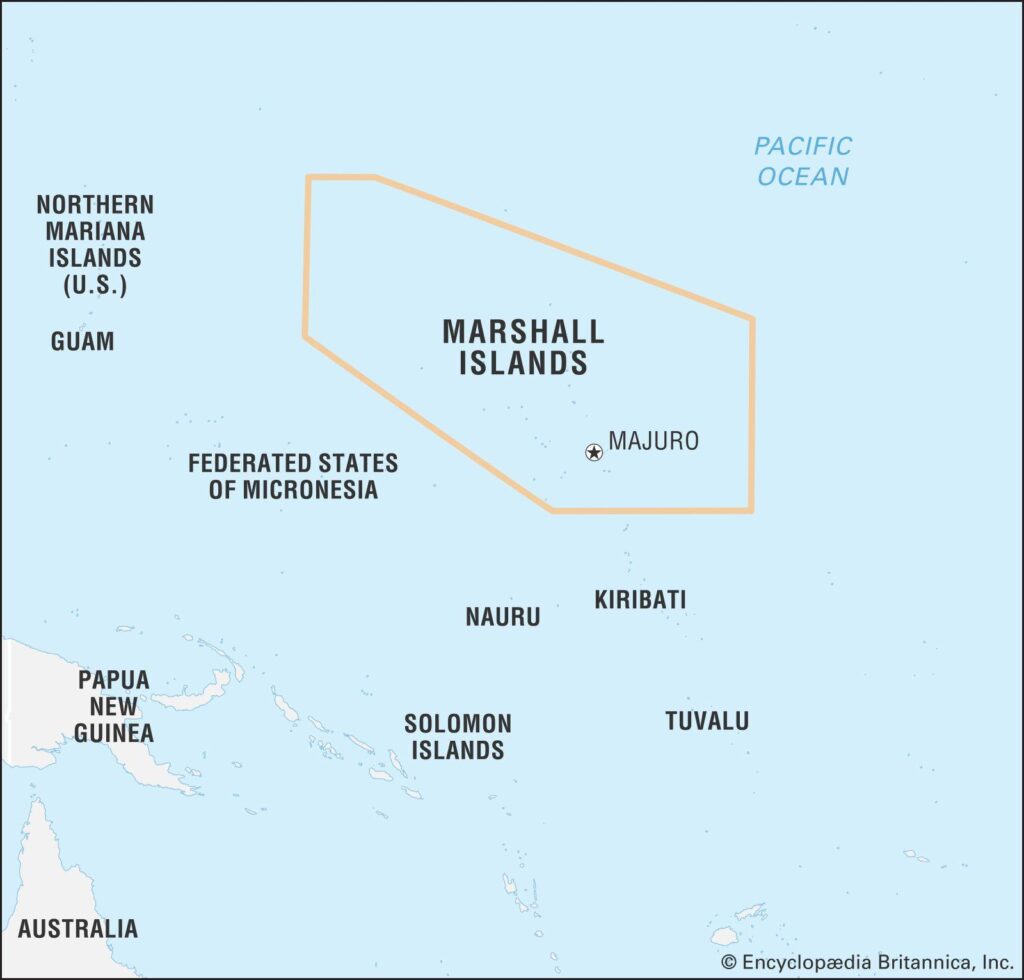

in a bid to bolster economic resilience and enhance revenue generation, teh Republic of the Marshall Islands is gearing up for significant reforms to its taxation framework, as outlined in a recent Technical Assistance Report from the International Monetary Fund (IMF). The report highlights critical recommendations aimed at overhauling the nationS consumption and income tax structures—an initiative designed to address fiscal challenges while promoting sustainable growth. With the Marshall Islands facing unique economic pressures, including reliance on external aid and vulnerability to natural disasters, the proposed reforms coudl serve as a catalyst for long-term stability. As stakeholders prepare to navigate these transformative changes, the implications for businesses, consumers, and the government will undoubtedly shape the fiscal landscape of this Pacific island nation.

Republic of the Marshall Islands Faces Fiscal Challenges Amid Consumption and Income Tax Reforms

The Republic of the Marshall Islands is currently navigating a complex landscape of fiscal challenges, especially in light of proposed reforms to its consumption and income tax systems. As the government seeks to enhance revenue generation amid tight budgetary constraints, stakeholders are expressing concerns regarding the potential impacts on local businesses and consumers. The initiative aims to streamline tax structures and broaden the tax base, which could lead to improved public services; however, the transition phase may induce short-term economic discomfort for manny residents.

key aspects of the reforms include:

- increased Compliance: Initiatives to enhance tax compliance rates through improved education and enforcement mechanisms.

- Broadening the Tax Base: Efforts to include more entities in the tax net, addressing current loopholes.

- Minimizing Tax Burden: A focus on ensuring that reforms do not disproportionately impact lower-income households.

In light of these efforts, the International Monetary Fund has highlighted the importance of thorough planning and consultation with community stakeholders to ensure that the reforms do not stifle economic growth. the delicate balance of achieving fiscal sustainability while protecting vulnerable populations remains at the forefront of discussions among policymakers.

IMF Reports Comprehensive Strategies for Economic Stabilization and Revenue Enhancement

The International Monetary Fund has unveiled a robust framework aimed at improving the economic stability of the Republic of the Marshall Islands. this initiative is centered on the reform of consumption and income tax systems to foster sustainable growth. Among the key recommendations presented are:

- Broadening the tax base: Expanding the range of taxable activities to include sectors that were previously untapped.

- Enhancing compliance: Implementing advanced methodologies to improve taxpayer compliance through education and community engagement.

- Incentivizing investment: introducing tax incentives for foreign and local investors to stimulate economic progress.

To visualize the potential impact of these reforms, an analysis of projected revenue from various sectors illustrates significant gains. The table below summarizes the anticipated revenue enhancements over the next five years:

| Sector | Current Revenue (2023) | Projected Revenue (2028) | Increase (%) |

|---|---|---|---|

| Tourism | $5 million | $8 million | 60% |

| Fishing | $2 million | $4 million | 100% |

| Commerce | $3 million | $6 million | 100% |

This comprehensive strategy not only positions the Marshall Islands for financial resilience but also emphasizes the importance of collaboration between governmental and non-governmental entities to achieve these objectives. Moving forward, the government’s commitment to openness and effective use of resources will be crucial for the success of these reforms.

Targeted Recommendations Aim to Strengthen Tax Compliance and Modernize Tax Administration

To enhance tax compliance and modernize tax administration in the Republic of the Marshall Islands, a series of targeted recommendations have been proposed. These strategies focus on improving the efficiency and effectiveness of the current tax system, which is essential for sustainable economic growth.Key recommendations include:

- Streamlining Tax Processes: Implementing automated systems to reduce manual processing and minimize errors.

- Enhancing Taxpayer Services: Developing user-pleasant online platforms to facilitate self-assessment and payment of taxes.

- Capacity Building: Investing in training programs for tax officials to strengthen enforcement and compliance measures.

Furthermore, modernization efforts could benefit significantly from data analytics to identify compliance gaps and make informed policy adjustments. By leveraging technology, the Marshall Islands can better track taxable income and consumption, ensuring that all citizens contribute their fair share. A well-structured approach may include:

| Strategy | Expected Outcome |

|---|---|

| Digital Tax Platforms | Improved payment rates and reduced evasion |

| Public Awareness Campaigns | Increased understanding of tax obligations |

| Regular Audits and Inspections | Higher compliance rates through accountability |

In Retrospect

the International Monetary Fund’s Technical Assistance report on Consumption and Income Tax Reform in the Republic of the Marshall Islands underscores a critical juncture for the nation’s economic landscape. As the government seeks to enhance fiscal revenue and streamline tax compliance, the recommendations outlined by the IMF offer a blueprint for sustainable financial stewardship. By embracing these reforms, the Marshall Islands can not only improve its economic resilience but also create a more equitable tax system that benefits all citizens. The path ahead is not without challenges, but with strategic implementation and political will, the nation stands poised to usher in a new era of fiscal stability and growth. Continued attention from stakeholders will be essential as the Marshall Islands navigates these significant changes, aiming to secure a prosperous future for its people.