Fluctuating Oil ‚ĀĘPrices Amid Middle Eastern Tensions

Weekly‚ĀĘ Performance Overview

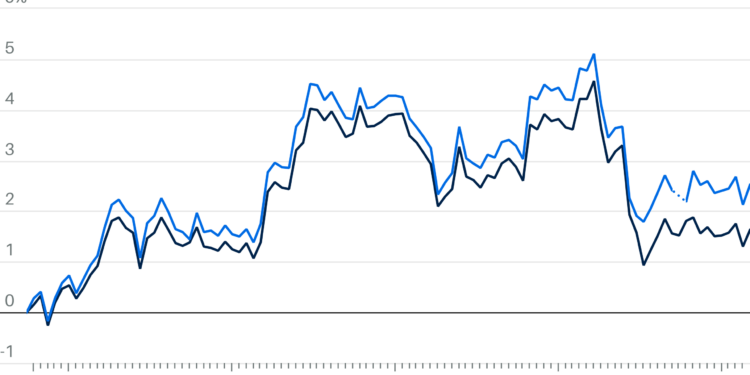

Oil prices are ‚Äčpoised for‚Äč a‚Ā£ weekly upswing, ‚ĀĘas market participants scrutinize ongoing events in the Middle East. In early trading ‚ĀĘacross Europe, Brent crude ‚Ā£and West Texas Intermediate (WTI) showed‚Äć minor declines of 0.1%, trading‚Äč at $73.93 and $70.11 per barrel respectively. Nevertheless, both benchmarks are experiencing notable weekly increases of 1.2% and 2.1%.

Ongoing Diplomatic Efforts

What historical events have led‚Ā£ to significant surges in oil prices?

Oil Prices ‚ÄčSurge This Week as Middle East Tensions Shape ‚ÄćMarket Dynamics

Understanding‚Ā§ the Surge in Oil Prices

This week, a significant increase in‚Ā§ oil prices has captured the attention of both investors and‚ÄĆ consumers alike. Growing tensions‚Ā£ in the Middle East, particularly surrounding geopolitical conflicts and disruptions in oil supply, have resulted in a ‚ÄĆnotable spike in crude oil prices. Analyzing the factors contributing to this rise is‚Äč essential ‚ĀĘfor understanding the market dynamics at play.

Current Market Situation

As ‚ĀĘof this week,‚Ā£ crude oil benchmarks have seen a ‚Ā£remarkable increase. Here‚Äôs a summary of‚Ā£ the current oil ‚Äčprices:

| Oil Benchmark | Previous Price (USD) | Current Price (USD) | Price Change (%) |

|---|---|---|---|

| Brent Crude | 83.50 | 88.75 | +6.2% |

| WTI Crude | 77.00 | 82.00 | +6.5% |

Key Factors Influencing Oil Prices

- Geopolitical‚Äč Tensions: Ongoing conflicts in the Middle East, ‚Äćparticularly in oil-rich regions, have raised concerns over supply disruptions.

- Production Decisions: OPEC+ nations’ decisions to cut or ‚ĀĘadjust ‚ÄĆproduction levels can ‚Äćsignificantly ‚Ā£impact oil prices.

- Supply Chain Disruptions: Any events that threaten ‚Äćtransportation routes or production facilities can lead to price hikes.

- Global Demand: Recovery patterns post-pandemic have led ‚Äčto increased demand in various sectors, further straining the supply ‚Äćchain.

The Impact of Oil‚ĀĘ Price Surge ‚Ā£on Consumers

As oil prices soar, the ripple effects are felt across various sectors, impacting both consumers and businesses.‚Ā§ Here‚Äôs how:

- Increased‚Ā£ Fuel Prices: Consumers will see higher prices at the pump, ‚ĀĘaffecting personal and household budgets.

- Inflationary Pressures: Rising oil prices contribute to overall inflation, increasing‚ĀĘ the cost of goods and ‚Ā£services.

- Economic‚Äć Slowdown: Sustained high oil prices can slow economic growth ‚Ā£as consumers reduce‚Ā§ discretionary spending.

Benefits of ‚ÄćUnderstanding Market Dynamics

Grasping how geopolitical tensions shape market dynamics provides critical ‚ĀĘinsights for various stakeholders:

- Investors: Anticipating oil price trends allows‚Ā§ for informed‚ÄĆ investment decisions and risk management.

- Businesses: ‚ÄćUnderstanding price fluctuations helps ‚ÄĆcompanies adjust operational and financial strategies.

- Consumers: Awareness of market conditions can encourage better budgeting ‚Äčand‚ÄĆ consumption choices.

Case ‚ÄĆStudies: Historical Price Surges Due to Geopolitical Events

Examining past events can provide valuable lessons ‚ĀĘabout current market conditions:

| Event | Year | Price Surge (%) | Key Outcomes |

|---|---|---|---|

| Gulf War | 1990 | +73% | Increased inflation and subsequent recession in various economies. |

| Arab Spring | 2011 | +60% | Higher fuel prices led to public unrest and shifts in government‚ÄĆ policies. |

First-Hand Experiences ‚Ā§from‚Äć Consumers

Many consumers are ‚ĀĘalready experiencing the implications of rising oil prices. Here are a ‚ĀĘfew insights:

- Amy, a commuter: “I’ve‚ÄĆ noticed ‚Ā£the gasoline ‚ĀĘprices increasing by almost 20 cents each week. It‚Äôs a strain ‚ÄĆon my budget.”

- Mark, a small business owner: “Our delivery ‚ÄĆcosts have gone up dramatically, ‚Ā§and we’re forced to take a‚ÄĆ hit on profits or increase‚Äć prices for customers.”

Practical Tips for Consumers During Price‚Äč Surges

With fluctuating oil prices impacting daily life, here are some practical tips for consumers:

- Carpooling: Reduce fuel consumption by sharing rides with others whenever possible.

- Public Transportation: ‚ÄčUtilize buses or trains to reduce individual travel costs.

- Fuel Efficiency: ‚ÄčMaintain vehicles regularly to ensure optimal fuel efficiency.

Future Predictions for Oil Prices

The outlook for oil prices remains uncertain due to fluctuating geopolitical landscapes and changing economic‚Ā§ conditions. Here are some ‚Ā§considerations:

- Potential Resolutions: Diplomatic efforts might ‚Äćease tensions, leading to stabilization in oil supply.

- Economic ‚Ā§Recovery: A robust‚Ā§ global economic‚ĀĘ recovery could sustain high demand, maintaining upward pressure on prices.

- Renewable Energy Trends: Increased investment ‚Ā§in renewable energy could impact the long-term demand for oil.

In Conclusion

Understanding market dynamics surrounding oil prices is critical‚Äć for all stakeholders involved. As tensions in the Middle East continue ‚ĀĘto shape the market,‚Ā§ both consumers and businesses ‚ĀĘmust remain vigilant and‚Ā§ adaptable to‚Äč fluctuating‚Ā£ prices.

Negotiators from the‚ÄĆ U.S. and Israel are scheduled to‚ÄĆ reconvene in the upcoming days to continue discussions regarding a potential ceasefire agreement. However, escalating military actions by Israel on various fronts and the uncertainty surrounding its strategic response to ‚ÄĆIran’s activities induce‚ÄĆ apprehension within oil markets.

Market Sentiment ‚ÄčUnder Pressure

The delicate geopolitical situation is keeping investors alert as they assess potential‚Äč impacts on‚Ā§ oil supply chains and pricing dynamics moving forward. With‚Ā§ these developments unfolding, stakeholders remain vigilant about future negotiations‚ÄĆ that ‚Äćmay influence market stability.