In a move that has sent shockwaves through global markets, former President Donald Trump has reignited concerns over transatlantic trade relations by threatening to impose new tariffs on both the European Union and the tech giant Apple. The potential for further trade restrictions adds to the uncertainty that has been a hallmark of U.S.-EU relations in recent years, as negotiations over trade practices and regulatory standards continue to unfold. This article explores the implications of Trump’s latest pronouncements, the historical context of U.S.-EU trade tensions, and the potential impact on consumers and businesses alike. With the specter of fresh tariffs looming, stakeholders on both sides of the Atlantic are bracing for what could be a tumultuous chapter in international trade.

Trump’s Tariff Threat: Unpacking the Implications for EU Trade Relations

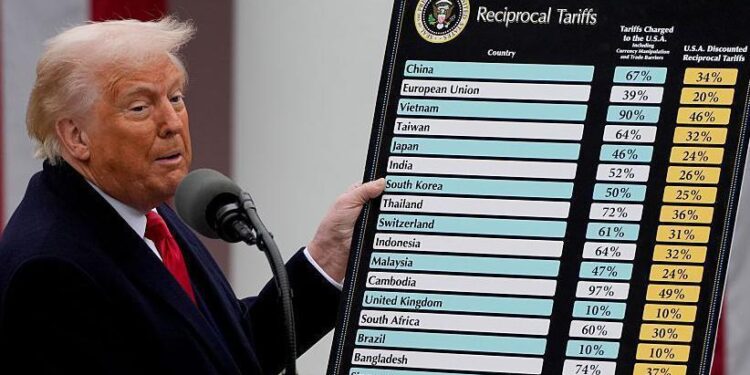

As former President Donald Trump hints at imposing new tariffs on EU products, the potential for renewed trade discord is palpable. This threat specifically targets industries crucial to the EU economy, including automotive, technology, and agriculture. Such tariffs could have numerous implications, including:

- Increased Costs: Higher tariffs would likely result in increased prices for European goods in the U.S. market, potentially making them less competitive.

- Retaliation: The EU may respond with its own tariffs on American goods, further escalating trade tensions.

- Market Uncertainty: Businesses on both sides of the Atlantic could face uncertainty, affecting investment and growth strategies.

The impact on major players, such as tech giant Apple, is particularly meaningful. Apple has ample manufacturing and supply chains that span both the U.S. and Europe. Should tariffs be imposed, it might need to adjust pricing strategies or reconsider its market presence.A table outlining the potential affected sectors and the expected consequences underscores the breadth of this issue:

| Sector | Potential Impact |

|---|---|

| Automotive | Price hikes leading to decreased sales |

| Technology | Higher production costs and reduced competitiveness |

| Agriculture | Export challenges and loss of market share |

Apple in the Crosshairs: Analyzing the Potential Impact on Global Supply Chains

The recent threats from former President Trump to impose new tariffs on the European Union,particularly targeting tech giants like Apple,have stirred concerns about the fragility of global supply chains. The tech industry, which heavily relies on cross-border trade, faces a precarious future if new tariffs are enacted. Companies may need to rearrange their operations, leading to potential increased costs for consumers and disruptions in product availability. The ripple effects of such tariffs could be felt not only by Apple but also by a vast network of suppliers and manufacturers that support its assembly processes.

In the event of tariffs, Apple could face significant financial implications that may force it to rethink its pricing strategies and manufacturing locations. Analysts suggest that the company could take several actions in response, including:

- Shifting production to countries with more favorable trade agreements

- Increasing prices on its products to absorb the costs

- Investing in option supply chains to mitigate risks

In such a scenario, the tech sector could see a realignment of its international partnerships, and competitors might capitalize on the ensuing market volatility. The stakes are high, and stakeholders across the globe are watching closely as the situation unfolds.

Strategic Recommendations for Businesses Amid Renewed Trade Uncertainties

In light of the renewed threat of tariffs on key imports from the European Union and tech giants like Apple, businesses should revisit their strategic frameworks to better navigate these uncertainties. Companies are advised to conduct a thorough risk assessment of their supply chains and consider diversifying their sourcing options to mitigate potential disruptions. Engaging in proactive dialog with local governments and trade associations can provide insights that help companies better prepare for legislative changes.

Additionally, firms should explore ways to enhance operational versatility and efficiency. This can be achieved through:

- Investing in technology: Embrace automation and data analytics to streamline production processes.

- Strengthening local partnerships: Collaborate with local suppliers to reduce dependence on international trade and minimize exposure to tariffs.

- Implementing cost control measures: Regularly review financials to identify areas where costs can be reduced without sacrificing quality.

| Strategy | Benefits |

|---|---|

| Diversify Suppliers | Reduces risk of reliance on single markets |

| Localize Production | Minimizes tariff impacts and shipping delays |

| Increase Inventory | Offers a buffer against supply chain disruptions |

Final Thoughts

President Trump’s renewed threats of imposing tariffs on the European Union and tech giant Apple signify a troubling escalation in ongoing trade tensions. As stakeholders in global markets brace for potential repercussions, these developments underscore the fragility of international trade relations and the far-reaching implications of protectionist policies. With both the EU and Apple poised to respond, the coming weeks will be pivotal in shaping the dynamics of U.S.-European trade ties. Policymakers, industry leaders, and consumers alike will be keenly watching as this situation unfolds, aware that shifts in trade policy can reverberate across economies and markets worldwide. As the dialogue continues, the emphasis on constructive negotiations will be crucial to mitigate the risks of a protracted trade conflict.