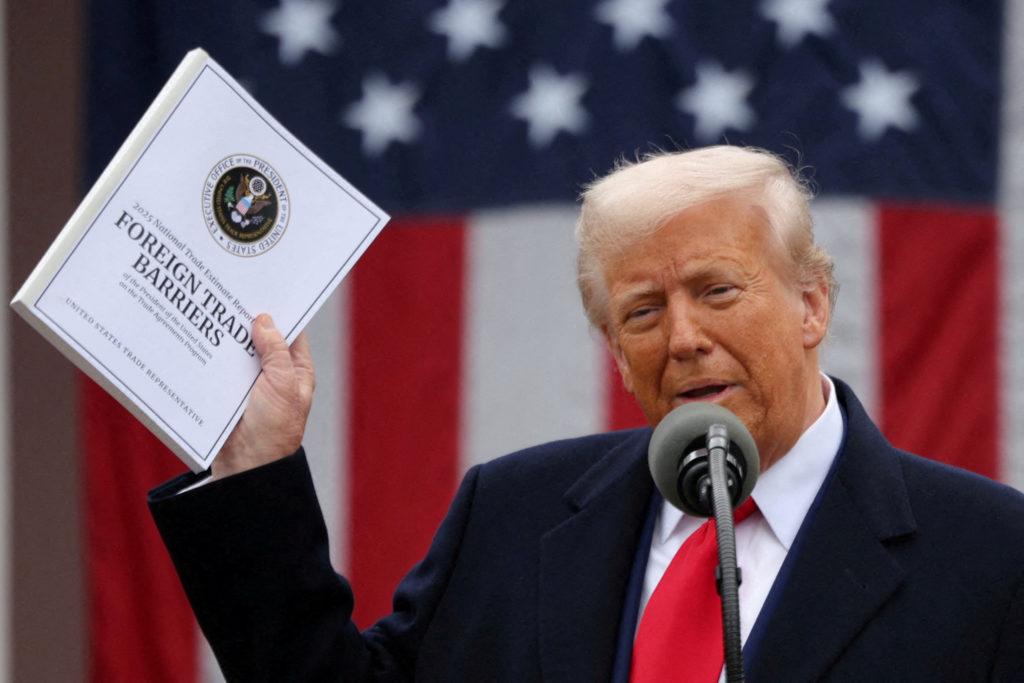

As speculation swirls around a potential 90-day pause in tariffs amid ongoing trade negotiations, stock markets are responding with notable volatility. The implications of President Donald Trump’s tariff policies have long been a focal point for investors, businesses, and economists alike, as they significantly impact both domestic and global markets. In this article, we provide live updates on the latest developments concerning Trump tariffs, analyzing the current market reactions and potential outcomes of a temporary tariff suspension. Stay tuned as we unpack how these evolving trade dynamics could shape the financial landscape in the coming days.

Trump Tariffs and Market Reactions Balancing Act Amid Ongoing Speculation

As speculation swirls around a potential 90-day pause on tariffs, markets are exhibiting notable volatility. Investors are closely monitoring developments,attempting to gauge how this temporary measure might influence economic growth and corporate profitability. Concerns about trade tensions and their long-term repercussions are juxtaposed with hopes for a thaw in U.S.-China relations,leading to mixed reactions across various sectors. The uncertainty of tariff impacts has caused some investors to reassess risks, pushing them towards more stable asset classes.

The reactions from key sectors provide insight into the broader market dynamics at play:

- Technology: generally more sensitive to tariff fluctuations, many tech stocks have displayed erratic trading patterns as investors digest potential impacts on supply chains.

- Manufacturing: Companies reliant on imports have seen stock prices dip amid fears of increased costs, while some firms are considering domestic alternatives.

- Financials: A stable interest rate habitat alongside tariff uncertainties has left banks wary, influencing lending behaviors.

| Sector | Market Reaction |

|---|---|

| Technology | High volatility,mixed investor sentiment |

| Manufacturing | Declines due to cost fears |

| Financials | Cautious approach,slow lending |

Economic Implications of the 90-Day Tariff Pause for Investors and Businesses

The declaration of a 90-day tariff pause has stirred mixed reactions among investors and businesses,creating a complex landscape of opportunities and uncertainties. Businesses reliant on imports could see a temporary relief from the pressures of increased costs, perhaps allowing them to stabilize their operations or reinvest in growth. conversely, the pause may also foster a sense of uncertainty that deters long-term investment decisions as firms question whether this break is merely a lull before renewed tariff hostilities. The impact on supply chains will be notably significant, as companies reassess logistics and sourcing strategies during this critical period.

As stock markets react to the evolving landscape, investors are grappling with various factors influencing their portfolios. Key implications include:

- Volatility: Expect short-term fluctuations in stock prices as markets adjust to the news.

- Sector Performance: Industries like agriculture and manufacturing may experiance varying degrees of risk and prospect.

- Global Trade Relations: The pause could lead to negotiations that might redefine trade relationships.

Additionally, a closer look at the potential economic shifts reveals some key sectors that might experience significant changes in the wake of this tariff pause:

| Sector | Potential Impact |

|---|---|

| Consumer Goods | Stable prices, potential inventory build-up |

| Technology | Increased production flexibility, boosted R&D investments |

| Manufacturing | Cost savings from reduced tariffs, risk of retaliatory measures |

strategies for Navigating Stocks During Uncertain Trade Policy Environments

Navigating the stock market amidst fluctuating trade policies requires a vigilant and adaptive approach. Investors should consider diversifying their portfolio to mitigate risks associated with high volatility in specific sectors directly influenced by tariffs. By spreading investments across various industries, including those less impacted by trade disputes, one can create a buffer against unexpected policy shifts. Additionally, keeping a close watch on economic indicators and earnings reports can provide essential insights into how companies are maneuvering through a turbulent trade landscape, allowing investors to make more informed decisions.

Moreover, maintaining an understanding of global market trends is crucial. As international trade dynamics change, the implications can ripple through the stock market. Investors may want to focus on sectors that could benefit from changes, such as technology and agriculture, which often display resilience or adaptability in uncertain environments. Utilizing tools such as stop-loss orders can also be a strategic move, enabling investors to protect their capital from sharp downturns during sudden policy announcements. Engaging with financial analysts and staying updated on news related to trade negotiations can enhance one’s ability to anticipate and react to market movements effectively.

In Conclusion

as the global markets react to the ongoing developments surrounding President Trump’s tariff policies, the speculation surrounding a potential 90-day tariff pause continues to create ripples across Wall Street. Investors are closely monitoring the situation, weighing the implications of shifting trade dynamics on the economy and corporate earnings.With the uncertainty lingering, it remains crucial for stakeholders to remain vigilant and informed. As we continue to provide live updates on this evolving story, we encourage readers to stay tuned to our coverage for the latest insights and analysis on how these tariffs could shape the financial landscape in the coming months. The interplay between trade policies and market performance promises to be a significant focus area as we look ahead.