Norway’s Government Pension Fund Global, commonly referred to as the Oil Fund, has experienced significant growth, buoyed by the robust performance of global equity markets. As reported by The Wall Street Journal, this sovereign wealth fund, which invests the surplus revenues from the country’s oil and gas sector, has capitalized on a remarkable upswing in stock prices over the past year. With its portfolio now surpassing record levels, the fund’s impressive performance underscores not only the resilience of the financial markets but also Norway’s strategic management of its energy wealth. As the Norwegian government looks to further diversify its investments, the Oil Fund’s growth raises important questions about the future of sustainable investing and the impact of volatile markets on long-term financial strategies.

Norway’s Oil Fund Surges Amid Record Equity Performance

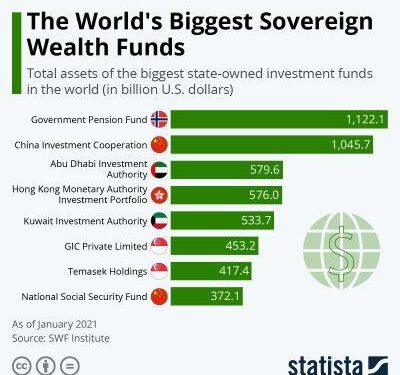

Recent data has revealed that Norway’s Sovereign Wealth Fund, commonly known as the Oil Fund, has achieved impressive growth in the wake of soaring equity markets. The fund, primarily fueled by the country’s robust oil revenue, reported a substantial increase in its overall value as it capitalized on strong performance across various sectors. This upswing, attributed to favorable market conditions, has positioned the fund as one of the largest sovereign wealth funds globally, with assets exceeding $1.4 trillion.

Key drivers behind this remarkable surge include:

- Record-high global equities: Major stock indices have reached all-time highs, enhancing the fund’s equity holdings.

- Sector performance: Technology and healthcare stocks have notably outperformed traditional industries, contributing significantly to the fund’s returns.

- Strategic reallocation: The fund’s management has effectively diversified its investments, reducing risk while maximizing returns.

| Sector | Return (%) |

|---|---|

| Technology | 27 |

| Healthcare | 22 |

| Energy | 15 |

| Financials | 18 |

This burgeoning success highlights Norway’s strategic investment approach and its unwavering resolve to foster sustained growth, even amid fluctuating global economic conditions. The fund not only serves as a financial buffer for future generations but also plays a pivotal role in Norway’s overall economic stability.

Strategic Insights on Leveraging Market Gains for Future Growth

In the wake of a robust recovery in global equity markets, Norway’s sovereign wealth fund, officially known as the Government Pension Fund Global, has seen significant growth, underscoring the importance of strategic asset allocation. This growth offers a prime opportunity for stakeholders to reconsider their investment strategies. Key factors driving this success include:

- Diversification: A well-balanced mix of assets has allowed the fund to navigate market volatility effectively.

- Global Exposure: Investments across various sectors and geographies have minimized risk while maximizing returns.

- Long-term Vision: A focus on sustainable and forward-thinking investments positions the fund for continued growth.

Looking ahead, the fund’s managers are tasked with not only preserving gains but also seizing emerging opportunities. As markets evolve, they must remain vigilant in identifying trends, particularly in technology and renewable energy sectors. To balance risks and rewards effectively, potential strategies may include:

| Strategy | Description |

|---|---|

| Enhanced Due Diligence | Conducting thorough analyses to assess potential investment risks and rewards. |

| Active Management | Shifting assets dynamically in response to market changes to capture better returns. |

| Sustainable Investments | Focusing on eco-friendly companies that align with global sustainability goals. |

Recommendations for Sustainable Investment in an Uncertain Economic Climate

As global markets continue to exhibit volatility, investors should consider a multifaceted approach to secure sustainable returns. Diversification remains crucial; spreading investments across various sectors and asset classes can buffer against downturns in specific areas. Additionally, focusing on impact investing allows individuals to support companies that prioritize environmental, social, and governance (ESG) factors. This alignment not only addresses ethical considerations but also caters to an increasing consumer preference for sustainable practices. Furthermore, integrating carbon screening into portfolios can help reduce exposure to companies with significant carbon footprints, thereby aligning with long-term trends towards decarbonization.

Monitoring regulatory landscapes and market demand shifts is essential as countries tighten environmental policies. Investors should pay close attention to emerging technologies and renewable energy sectors poised for growth. For example, investing in startups focused on sustainable agriculture or innovative waste management solutions can yield significant returns in an increasingly environmentally conscious economy. To facilitate these strategies, investors may also explore platforms that offer ESG-focused funds or green bonds, which can provide a reliable income stream while promoting sustainable development initiatives. Creating a resilient investment strategy that prioritizes sustainability could position investors to capitalize on opportunities in an uncertain economic climate.

The Way Forward

In conclusion, Norway’s sovereign wealth fund continues to capitalize on robust equity market performance, showcasing its resilience and adaptive investment strategy. As highlighted by recent reports in The Wall Street Journal, the fund’s growth not only underscores Norway’s strategic foresight in resource management but also reflects broader trends within global markets. Looking ahead, observers will be keen to see how fluctuating economic conditions and geopolitical factors may influence the fund’s trajectory. With its impressive portfolio, the Oil Fund remains a pivotal player in securing the future financial stability of Norway, further solidifying its position in the landscape of international finance.