In a volatile trading session on Monday,Bulgarian equity indices displayed a mixed performance,with the benchmark SOFIX index managing to edge up amid broader market declines.While many sectors faced downward pressure, the resilience of the SOFIX underscores selective investor confidence in leading Bulgarian stocks.As market participants digest economic indicators and global trends, analysts are closely monitoring the dynamics within Bulgaria’s financial landscape.This article delves into the latest movements in Bulgarian equities and the factors influencing these fluctuations,providing a comprehensive overview of the market’s current state.

Bulgarian Equity Market Trends Show Mixed Signals as SOFIX Gains Slight ground

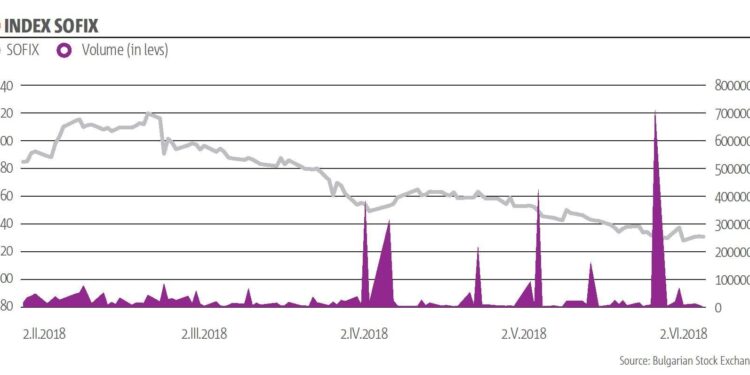

In a week marked by uncertainty, Bulgarian equity indices have displayed a mixed performance, with varied sectoral responses. notably,the SOFIX index,which tracks the largest and most liquid stocks on the Bulgarian Stock Exchange,has managed to gain 0.2%,closing at 585.67 points. This uptick came despite a downward trend seen in other indices, reflecting the divergent nature of investor sentiment across sectors. Analysts point out that key drivers for the SOFIX’s slight enhancement include strong performances in financial and energy sectors, contributing positively to the overall index.

Conversely,several smaller indices,such as the BGBX 40 and BGREIT,have struggled,illustrating the challenges faced by some sectors amid shifting market dynamics. Concerns surrounding inflation and geopolitical factors continue to weigh on investor confidence.Crucial trends to watch include:

- Sector-specific volatility: Mixed earnings reports have led to disparities in stock performance.

- Foreign investment trends: Continued interest from international investors is critical for market stabilization.

- Regulatory impacts: upcoming changes in regulations could influence market perceptions and valuations.

| Index | Performance (%) |

|---|---|

| SOFIX | +0.2 |

| BGBX 40 | -0.5 |

| BGREIT | -1.0 |

Investor Sentiment Shifts Amid Declining Indices with Focus on Strategic Opportunities

As Bulgarian equity indices encounter downward pressure, investor sentiment reflects a gradual but notable shift toward strategic opportunities in the market. The fluctuations in major indices, alongside global economic uncertainties, have prompted investors to reassess their portfolios. Instead of succumbing to panic selling, many are seeking to identify undervalued assets that could rebound as the economic landscape stabilizes.Observations indicate that sectors such as technology and renewable energy are gaining traction among savvy investors looking for resilient growth.

In this evolving market environment, the SOFIX index has uniquely managed to cling to modest gains, hinting at a selective optimism among traders. Factors such as stable corporate earnings, government initiatives, and increased foreign investment are contributing to this positive momentum. Investors are increasingly motivated to dig deeper into individual stock performances, favoring companies with solid fundamentals and innovation potential. The following table highlights a selection of sectors and their recent performance, aiding in informed investment decisions.

| Sector | recent performance | Outlook |

|---|---|---|

| Technology | +5.3% | Promising with robust growth potential. |

| Renewable Energy | +3.1% | Increasing interest following policy support. |

| Financial Services | -1.2% | Stable, navigating regulatory changes. |

Key Sector Performances Influence Market dynamics and Future Investment Strategies

Recent trading sessions have revealed a mixed performance across Bulgarian equity indices, reflecting the intricate tapestry of sector dynamics that shape market trajectories. While the major indices have generally trended downwards,the SOFIX index managed to gain slight momentum,indicating a potential divergence in investor sentiment. Key sectors such as financial services, energy, and technology require close scrutiny as they hold the power to sway market movements and investment strategies moving forward. Investors have been especially attentive to:

- Energy Sector: Fluctuations in international oil prices and local production levels could substantially influence the valuation of energy stocks.

- Financial Services: Bank performance, interest rates, and lending trends are critical indicators for stakeholders aiming to navigate this sector.

- Technology: The ongoing digital transformation mandates a reassessment of tech investments amid growing competition and innovation.

As investors analyze the latest trends, the correlation between sector performances and broader market conditions reveals potential avenues for strategic investments. For example, the table below illustrates the recent performance of notable sectors within the Bulgarian market, offering insights into possible shifts in investment focus:

| sector | Recent Performance | Outlook |

|---|---|---|

| Financial Services | -1.2% | Volatility expected due to interest rate changes |

| Energy | +0.5% | Stable growth anticipated amidst fluctuating prices |

| Technology | +2.0% | Continued expansion driven by innovation |

understanding these dynamics can empower investors to recalibrate their strategies, aligning with emerging trends and anticipated shifts in market sentiment. As sectors fluctuate, the nuanced responses from the equity indices highlight the necessity for vigilant monitoring and analysis when formulating future investment plans.

Final Thoughts

the latest developments in the Bulgarian equity market reveal a mixed bag of performance across various indices, with the benchmark SOFIX managing a slight uptick against a backdrop of broader declines. As investors navigate these fluctuating conditions, market participants will be keenly observing economic indicators and corporate earnings that may influence future trends. The resilience of the SOFIX could imply underlying strengths amidst the volatility, providing a point of interest for analysts and investors alike. Continued monitoring of the market will be essential as we move forward in an uncertain economic environment.