Bulgarian banks could face greater scrutiny and higher costs after the Financial Action Task Force added the country to its greylist on October 27.

The list, created in 1989 by G7 countries, includes nations facing increased monitoring due to strategic deficiencies in their government’s ability to tackle money laundering and counter terrorist financing.

Greylisting may result in greater difficulties in maintaining correspondent banking relationships and accessing external finance, according to S&P Global Market Intelligence. However, lenders should face a limited impact on liquidity risk.

The sector’s dominance by banks owned by EU-based financial institutions will limit the greylisting fallout for local lenders, adds S&P.

The consequences experienced by countries placed on the greylist have been the subject of various economic studies. There is a reduction in the ratio of foreign direct investment to gross domestic product and a decrease in payments received by the greylisted country from the rest of the world.

An analysis of global bank inflows between 2010 and 2015 found a decrease in cross-border liabilities of about 16%.

One reason for this economic damage is the reaction of correspondent banks, which are required to consider the greylisted status as part of their anti-money laundering (AML)/countering the financing of terrorism procedures. This often results in a disincentive to work with clients from such countries, because additional resources must be devoted to managing those relationships.

However, Bulgaria’s banking sector is stable for now, with solid capital levels and improving asset quality, according to Fitch Ratings.

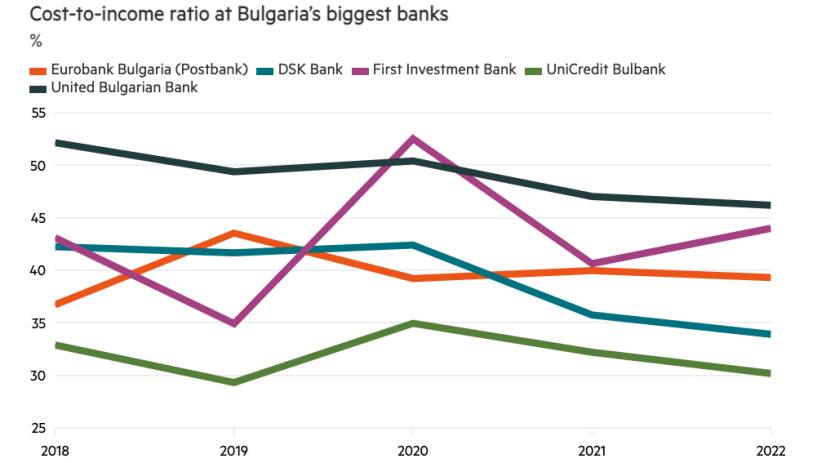

The Bulgarian banking sector possesses good efficiency levels. DSK Bank — the country’s largest bank by Tier 1 capital — saw its cost-to-income ratio improve from 42.2% to 33.9% at the end of 2022, while fifth-largest United Bulgarian Bank’s fell from 52.1% to 46.2% over the same period.

As of the end of June 2023, the return on assets (ROA) of the banking system reached 2.2%, compared with European banks’ average ROA of 0.7% in the first quarter of 2023, according to the latest European Central Bank data.

At the end of the second quarter of 2023, Bulgaria’s banking sector reported a net profit growth of 66% year on year, following continuing growth in loans, widening net interest income and low levels of interest rates on deposits, says the Association of Banks in Bulgaria.

Bulgaria’s economy is expected to slow down in 2023 to 1.4%, in line with the ongoing cooling in the eurozone, says the World Bank.

However, there is a chance that the greylisting could further delay Bulgaria’s entry into the eurozone.

The country originally planned to adopt the euro in January 2024 but delayed entry by a year after failing to meet the entry criteria on inflation and implement necessary legislative reforms amid political instability in the country.

Bulgarian authorities are likely to introduce AML regulatory enhancements in the near term, which means domestic financial institutions would face increased scrutiny and more comprehensive reporting requirements.

To be removed from the list, countries need to demonstrate that they have addressed the weaknesses that have been identified in their controls against money-laundering, terrorist financing and proliferation financing.

Source link : https://www.thebanker.com/Bulgarian-banks-could-face-higher-costs-after-country-s-greylisting-1700554569

Author :

Publish date : 2023-11-21 03:00:00

Copyright for syndicated content belongs to the linked Source.