Economic Insights: Bostic’s Address ‚Äćand the Global ‚ĀĘFinancial Landscape

A Look ‚Ā£at Bostic’s Comments

At 1900 EST, Federal Reserve Bank of Atlanta President Raphael Bostic will engage ‚Ā§in a‚ĀĘ moderated dialogue discussing the economic forecast and its implications for small‚Ā£ businesses. Last week, he highlighted significant concerns regarding ‚ÄĆthe fiscal trajectory earlier this year, prompting a‚ÄĆ shift in expectations for the ‚ÄćFederal Open Market Committee (FOMC). This shift saw predictions for six ‚ÄĆor seven interest rate reductions this year ‚ÄĆto a halt ‚Ā£until September.

Global Inflation Trends

In addition, attention will be directed toward New Zealand’s Consumer Price‚ĀĘ Index (CPI) data release. Economists forecast that inflation rates are likely to ‚ÄĆdecline further.‚ĀĘ The Reserve‚Äć Bank of New Zealand (RBNZ) has now embarked‚Äč on an easing cycle; however,‚Äč any unexpected rise in inflation could lead market participants to reconsider their projections about the RBNZ‚Äôs forthcoming rate cuts.

“`plaintext

“`html

Unlocking Market‚Äč Insights:‚Ā£ Key Highlights from Asia’s Economic Calendar on October 16, 2024 ‚Äď Fed’s Bostic Takes the‚ĀĘ Stage!

Understanding the ‚ÄčImportance of Economic Calendars

Economic calendars are invaluable tools for traders, investors, and analysts looking to navigate the complexities of market fluctuations. On October 16, 2024,‚ĀĘ Asia’s economic calendar ‚Ā§featured several key events that could significantly influence market dynamics. With global‚Ā£ interconnectedness becoming‚ÄĆ a reality, ‚Äćthe implications of these events ‚ĀĘextend far beyond Asia,‚ĀĘ impacting economies around ‚Äčthe world.

Key Highlights ‚Äćfrom Asia’s Economic Calendar on October 16, 2024

October 16, 2024, ‚Äčpresents‚Äć an array of critical economic ‚Äčdata releases across Asia. Here are the major highlights:

| Country | Event | Time (GMT) | Impact Level |

|---|---|---|---|

| Japan | Trade Balance | 00:50 | High |

| China | GDP Growth Rate | 03:00 | High |

| Australia | Employment Change | 02:30 | Medium |

| Singapore | Inflation Rate | 04:00 | Medium |

| South ‚ÄĆKorea | Bank of Korea ‚Ā§Rate Decision | 08:00 | Very High |

Focal Point: Fed’s Bostic Takes the Stage

On the same day, Federal Reserve Bank President Raphael Bostic is scheduled to ‚Ā£deliver a key speech. His insights are expected‚ÄĆ to‚Äć provide a deeper‚ĀĘ understanding of the Fed’s monetary policy direction, especially in the context of Asia’s economic performance.

Why‚ĀĘ Bostic’s Speech Matters

- Policy‚Ā£ Direction: Bostic‚Äôs remarks will ‚Ā£shed light on the Fed’s stance regarding interest rates‚Ā§ and inflation, which are pivotal for global ‚ÄĆfinance.

- Influence on Forex‚Ā£ Markets: Traders in the Forex ‚Äćmarkets will closely monitor Bostic‚Äôs comments, as they can cause significant volatility across ‚Ā£currency ‚Ā£pairs.

- Market‚ÄĆ Sentiment: His insights may influence‚Äć investor confidence not only in the U.S. but also across Asian markets, impacting capital flows‚Ā§ between continents.

Benefits of Following the Economic Calendar

Understanding‚Ā§ the key ‚Ā£events in ‚Ā£Asia’s economic calendar can significantly benefit ‚Äčtraders and‚Ā§ investors. ‚ÄćHere are some advantages:

- Informed Decision Making: Knowing when important data is released ‚Ā£helps in making educated investment decisions.

- Risk Management: Awareness of potential market-moving announcements helps ‚Äćin managing ‚Ā§risks effectively.

- Seizing Opportunities: Traders can spot ‚ĀĘtrends and capitalize on market movements driven by ‚ĀĘeconomic indicators.

Practical Tips for Navigating Economic Events

As October 16 approaches, here are some practical tips to enhance your trading strategy:

- Stay Updated: Follow reliable financial‚ÄĆ news platforms and subscribe to‚Äć economic calendars ‚ĀĘfor real-time updates.

- Utilize Technical Analysis: Combine economic data with technical analysis to strengthen your trading strategy.

- Prepare for‚Ā£ Volatility: Have a‚Ā£ plan in place to manage any swift market movements that may arise due to the economic news.

Case Studies: Responses to Previous Economic Events

Looking back at previous instances can provide insights into market behaviors in response to key economic announcements. Below are two notable case studies:

Case Study 1: Japan’s Trade Balance Release – April 2023

In ‚ĀĘApril 2023, Japan‚Äč reported ‚Äća surprising trade surplus, leading to a 2% appreciation ‚Äćof the yen against major currencies. Traders who ‚Ā§anticipated this outcome based on the economic calendar capitalized by entering long positions ‚Äćbefore the announcement.

Case Study 2: China’s GDP‚Ā£ Growth Rate – July 2023

The July 2023‚Äć GDP figures showed stronger-than-expected growth. As a result, ‚ÄčAsian stock markets reacted positively, with sectors linked to commodities witnessing robust gains. Investors and analysts who stayed alert to the economic calendar benefitted‚Ā§ from timely investments.

First-Hand ‚ÄĆExperience:‚Ā§ Preparing for Economic Announcements

As a trader who has navigated‚Ā§ numerous key economic announcements,‚ÄĆ maintaining a‚Äć structured approach is vital. Here‚Äôs what ‚Ā£I‚Äôve learned:

- Always check the economic calendar days in advance‚Ā£ and mark key events.

- Review historical data for the ‚Ā§markets you ‚ÄĆtrade to gauge potential reactions.

- Engage in ‚Ā£community discussions ‚Ā£to share ‚Ā£insights and gather perspectives.

Conclusion: The‚Äč Path to Market Success

effectively utilizing Asia’s economic calendar

An Overview of Economic Data Releases

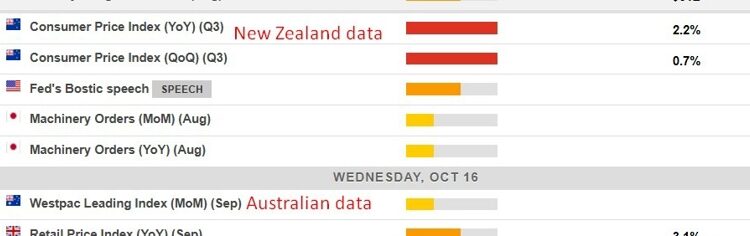

The ForexLive economic‚ÄĆ calendar‚Äč provides a comprehensive snapshot of upcoming financial events and data releases. The times displayed correspond to GMT on the left side of the table. On the far right are figures representing previous results from last month ‚Äčor quarter, while ‚Ā§adjacent is‚Ā§ an indication of consensus median expectations.

It‚Äôs worth noting that New Zealand and Australia data may feature similar‚Äč flag icons‚Ā£ which can lead to confusion;‚ÄĆ thus careful attention should be paid when interpreting these economic indicators.

Conclusion: Navigating Uncertainty

As small ‚ĀĘbusinesses brace for potential shifts shaped by both‚Ā§ domestic policies and global trends such as those indicated by Bostic’s remarks and New Zealand‚Äôs CPI insights, staying informed ‚ÄĆwill be crucial for ‚ÄĆstrategic decision-making moving forward in an ‚Ā£ever-evolving ‚ÄĆeconomic landscape.