Insights from the Federal Reserve: Key Events and Economic Perspectives

Upcoming Discussions on Sports and Economic Trends

At 2200 GMT (1800 US Eastern Time), President Raphael Bostic of the Federal Reserve Bank of Atlanta will lead a discussion titled “Dynamic Business of Professional Sports.” This event is part of the Atlanta Fed’s Leading Voice Series, aimed at examining the intersection of economics and professional athletics.

St. Louis Fed’s Insights into Monetary Policy

“`plaintext

“`html

Unlocking Market Insights: Key Economic Events in Asia for October 8, 2024

Overview of Economic Events

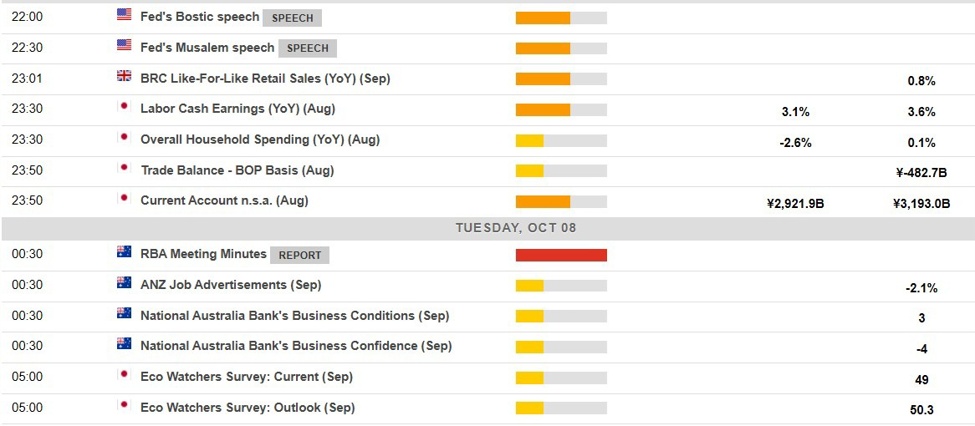

October 8, 2024, is set to be a significant date for investors and traders focusing on Asian markets. This article explores critical economic events such as Federal Reserve speeches, Reserve Bank of Australia (RBA) minutes, and other important announcements that can influence market trends. Understanding these events is vital for making informed decisions in trading and investment.

Key Events to Watch

- Federal Reserve Speeches

- RBA Minutes Release

- Chinese Economic Data Releases

- Bank of Japan’s Monetary Policy Review

- Thai Baht Economic Indicators

Federal Reserve Speeches

On October 8, several Federal Reserve officials will deliver speeches. These discussions are expected to offer insights into the Fed’s monetary policy stance and will play a crucial role in shaping market expectations leading into the Federal Open Market Committee (FOMC) meeting later in the month.

Potential Topics of Discussion

- Inflation outlook

- Interest rate projections

- Job market conditions

- Global economic impacts

Impact on Asian Markets

The Federal Reserve’s comments can significantly influence foreign exchange rates, particularly for the USD/JPY and AUD/USD pairs. Analysts will be keenly observing how Federal Reserve officials communicate their economic outlook, which could result in heightened volatility in these currency pairs.

Reserve Bank of Australia (RBA) Minutes

The RBA will also release its minutes from the previous monetary policy meeting on October 8. These minutes will provide valuable insights into the central bank’s assessment of the Australian economy and its future policy directions.

Key Points Expected from the RBA Minutes

- Recent economic performance indicators

- Consumer spending trends

- Interest rate decisions and justifications

- Potential risks to economic growth

Market Reactions to RBA Minutes

Market participants typically react swiftly to the RBA minutes, especially regarding the Australian dollar. Investors should be prepared for potential fluctuations in AUD value as traders adjust their positions based on the RBA’s insights.

Chinese Economic Data Releases

October is critical for Chinese economic indicators, including GDP growth rates and manufacturing activity reports, which are scheduled to be released around this date. These figures provide a snapshot of China’s economic health and can impact commodities and regional currencies significantly.

Key Indicators to Watch

| Indicator | Previous Value | Forecast |

|---|---|---|

| GDP Growth Rate | 5.1% | 5.3% |

| Manufacturing PMI | 49.5 | 50.2 |

Market Implications of Chinese Data

The results from these indicators can have wide-ranging effects on global markets. A stronger-than-expected GDP growth rate can bolster investor sentiment and strengthen Asian currencies, while disappointing figures may trigger sell-offs in equities and commodities.

Bank of Japan’s Monetary Policy Review

The Bank of Japan (BOJ) is also scheduled for a monetary policy review on October 8. The BOJ’s decisions and insights into its monetary policy can influence the Yen and other Asian currencies.

What to Expect from BOJ’s Review

- Interest Rate Policies: Any hints of tightening or loosening can significantly impact the JPY.

- Market Sentiment: The BOJ’s perspective on the global economy will be closely scrutinized.

- Inflation Targets: Insights into the inflation outlook will inform market predictions.

Thai Baht Economic Indicators

Significance of Thai Economic Data

On October 8, Thailand will release various economic indicators, including inflation rates and economic growth figures. The Thai Baht often reacts to these releases due to Thailand’s growing role in regional economic stability and tourism.

Important Indicators to Consider

| Indicator | Previous Value | Forecast |

|---|---|---|

| Inflation Rate | 3.8% | 4.0% |

| GDP Growth Rate | 2.5% | 2.8% |

Market Reaction to Thai Economic Data

Market analysts will be closely monitoring these indicators for potential impact on the Baht. An increase in inflation may lead to a hawkish stance from the Bank of Thailand, influencing market expectations.

Benefits of Staying Informed

- Informed Decision-Making: Investors can make confident choices based on economic projections.

- Market Timing: Understanding upcoming events allows traders to time their positions effectively.

- Risk Management: Being aware of potential volatility can help mitigate risk in trading strategies.

Practical Tips for Investors and Traders

- Stay updated on economic calendars that track crucial events.

- Follow relevant financial news websites for real-time updates on speeches and data releases.

- Utilize trading platforms that offer alerts for significant market movements.

- Engage in discussions on forums to share insights and interpretations of economic data.

Case Studies: Past Economic Events ImpactAnticipating Future Monetary Moves

Notably absent from today’s calendar is Andrew Hauser, Deputy Governor at the Reserve Bank of Australia, who will be speaking later about Australian economic conditions as part of his presentation for the Walkley Foundation at 0100 GMT (2100 US Eastern Time / midday Sydney time). The text for Hauser’s speech will be published afterward, alongside a question-and-answer segment that media representatives are invited to attend.

With September meeting minutes being released shortly before Hauser’s remarks, market analysts are keenly observing these communications for indicators regarding future actions by central banks. Current speculation suggests that there may be an interest rate cut anticipated by early 2025 (with many experts pinpointing Q1 as likely). This insight could have profound implications on trading strategies moving forward.