Exploring the Asian Investment Landscape: Insights from KKR

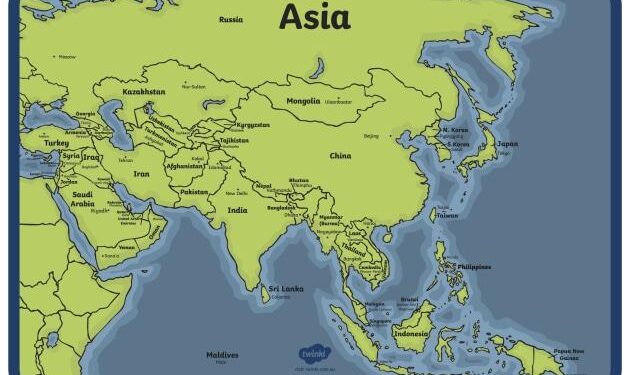

As global markets experience profound changes, the investment scene in Asia presents a myriad of opportunities and challenges for institutional investors. In this edition of “Exploring the Asian Investment Landscape,” KKR, a leading international investment firm, shares insightful observations drawn from their firsthand experiences across Asia’s vibrant regions. This article delves into the unique economic climates, regulatory environments, and cultural nuances that shape investment strategies in various Asian countries. By highlighting recent trends and KKR’s strategic approaches, we analyze how the firm skillfully navigates this dynamic region by utilizing local expertise to capitalize on emerging prospects amid uncertainties. Join us as we uncover essential insights from KKR’s exploration of Asia, offering a extensive understanding of how the continent is positioned at a crucial juncture for innovation and growth in today’s economy.

Investment Prospects in Asia: Analyzing KKR’s Strategic Focus

As KKR journeys through Asia’s multifaceted landscapes, its strategic focus has become increasingly evident. Certain sectors are drawing attention due to their potential for growth and innovation within this rapidly changing economic landscape. The following sectors are pivotal to KKR’s investment strategy:

- Technology: The rapid digital change across Southeast Asia is creating exciting opportunities in software growth, e-commerce, and fintech.

- Healthcare: With an aging population coupled with increasing healthcare needs, there are considerable opportunities within pharmaceuticals and medical technology.

- Infrastructure: Accelerated urbanization demands investments in sustainable energy solutions and transportation infrastructure to address future requirements.

The firm particularly seeks investments where strong governance frameworks coexist with innovative business models. Considering global trends impacting various markets, KKR anticipates positive developments especially within these regions:

| Market | Main Focus Areas | Predictive Growth (2023-2025) |

|---|---|---|

| India | Technology & Renewable Energy | 8% |

| China | Healthcare & Consumer Services | 6% |

| Southeast Asia | E-commerce & Digital Finance | 10% |

Diligently identifying these emerging prospects will be vital for KKR’s success within this region-enabling them not only to enhance returns but also contribute positively towards sustainable economic advancement throughout Asia.

Navigating Regulatory Landscapes: Essential Considerations for Investors in Asia

Navigating through diverse regulatory frameworks present across Asian markets can be intricate; each nation possesses its own set of regulations that can vary significantly even within different areas of one country. Understanding these nuances is crucial when making informed investment decisions.Key factors include:

- Local Regulations :The legal framework governing foreign investments varies widely between nations affecting taxation policies,labor laws,andcorporate governance standards.

- Political Environment :The stability or instability within political systems can lead to shifts that impact regulations; thus monitoring such changes is essential for investors.

- Compliance Requirements :Navigating compliance obligations can be challenging; comprehending local regulations helps mitigate risks associated with legal complications down the line .

Additonally , actively engaging withlocal legal experts along with regulatory bodies provides invaluable insights into upcoming trends and also potential hurdles . A comparative overview showcasing regulatory conditions across key nations may look like this :

Country Foreign Investment Restrictions Tax Incentives < td China< td Moderate< td Tax exemptions available within free trade zones< / td > < td India< td Sector-specific limitations< td Reduced tax rates applicable specifically targeting startups< / td > < td Vietnam< td Limited restrictions imposed on certain industries.< / t d >< t d Investment incentives offered particularly aimed at tech sectors.< / t d > Sustainability and Technology: Shaping Future Investments at KKR Across Asia

Keenly adjusting its investment strategy amid rapid transformations occurring throughout economies acrossAsia ,KKR places increasing emphasis uponsustainability .This shift reflects growing demand among consumers coupled with mounting regulatory pressures pushing businesses towards adopting more responsible practices .Areas such asrenewable energy sourcesand energy efficiency initiativesare gaining traction due largelyto changing mindsets around sustainability goals .By prioritizing companies alignedwiththese objectives ,we aimto generate long-term value not justfor our investorsbut also forthe communitiesand ecosystemsin whichour portfolio operates .The integrationof

- < strong>C lean Energy Solutions:< / strong>Pursuing investmentsin solarand wind technologiesaimedat reducingcarbon footprints.

- < strong>S mart Agriculture:< / strong>Leveragingdata analyticsforefficientresource management infoodproduction.

- < strong>waste Management Technologies:< / strong>Pioneeringinnovative methodsfocusedonrecyclingandwastereductionwithinurbanareas.To exemplify our commitmenttowards sustainabilityhereisabriefoverviewofselectedportfolio companiesrepresentingthisfocusoninnovation:

Conclusion Summary: Key Insights from KKR on Asian Markets

“InsightsfromtheJourney:Asia-KKRsummarizesintricateopportunities&challengesfoundwithinAsia’sevolvingmarkets.Asglobalfinancialtrendsevolve,theperspectivesofferedbyKKRprovideessentialguidanceonnavigatingthisdiverselandscape.Whetheritbe technologicaladvancementsacrossSoutheastAsiatochangingconsumerbehaviorsinmajor economies,itbecomesapparentthatAsiaremainsacentralfocusforinvestorslookingtocapturegrowthpotential.

Emergingfromunprecedenteddisruptionscausedbythepandemic,recoveryeffortshighlighttheresilience&adaptabilityexhibitedbybusinessesinthearea – underscoringnotonlyprofitpotentialbutalsoimportanceofstrategicallyapproachinginvestments.Lessonslearnedthroughoutthisjourneyserveasvaluableguidepostsforthoseaimingtounderstandcomplexitiesassociatedwithvibrantmarkets.Asthefutureunfolds,itbecomesclearthatongoingengagementalongwithcommitmenttounderstandinglocaldynamicswillprovecrucialforsuccesswithinAsia.TheinsightsgatheredherefromKKRresonatebeyondfinancialcircles,reachingpolicymakers&businessleadersalikeastheynavigatepathsforwardinamoredynamicworld.ThejourneythroughAsia’seconomiclandscapeisfarfromcomplete,andreflectionsarticulatedhereofferrobustfoundationfordecipheringwhatliesahead.”