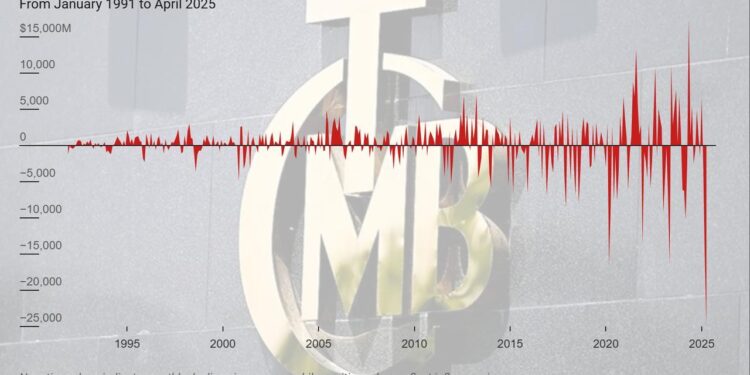

Turkey Faces Unprecedented Reserve Loss Amid Political and Economic Turbulence

In a troubling progress, Turkey has reported an unprecedented depletion of its reserves, with a staggering $25 billion loss recorded in April.This notable downturn is primarily attributed to the ongoing political instability, which has exacerbated the already fragile economic habitat. As protests against government policies escalate,confidence in the Turkish lira continues to plummet. Experts warn that this mix of internal strife and external pressures could further jeopardize Turkey’s financial stability. Major cities are experiencing heightened civil unrest, leading to increased volatility in currency markets.

The repercussions of this reserve depletion are far-reaching, affecting various sectors within the economy. The key factors contributing to this crisis include:

- Political Instability: Ongoing protests and calls for reform create an unpredictable atmosphere.

- Currencies Under Strain: The lira has substantially depreciated against major currencies, resulting in increased import costs.

- Lack of Investor Confidence: Both domestic and foreign investors are becoming increasingly wary, leading to capital flight and a decline in foreign direct investment.

The central bank now faces crucial decisions on how best to stabilize reserves while restoring faith in the economy amidst these challenges.

| Month | Change in Reserves ($ Billion) |

|---|---|

| March | -5 |

Analysts Warn of Ongoing Financial Instability as Lira Declines and Trust Erodes

The Turkish economy is grappling with severe challenges as analysts report an alarming reserve loss of $25 billion for April alone. This remarkable decline arises from multiple factors including significant political turmoil alongside efforts aimed at stabilizing the faltering lira through various interventions. Concerns are growing that such depletion not only indicates an immediate financial crisis but also undermines trust among both investors and citizens alike. The persistent political unrest intensifies an already precarious situation; without meaningful reforms, fears linger regarding further depreciation of the lira.

The effects of these developments can be seen across different sectors, resulting in increased volatility within foreign exchange markets along with declining consumer confidence. Key indicators include:

- Skyrocketing Inflation Rates: Following the lira’s depreciation, inflation rates have surged dramatically.

- Diminishing Foreign Investments:This trend reflects growing investor caution amid rising uncertainties.

- A Rise in Public Discontent:This discontent is manifesting through widespread protests demanding economic accountability.

| Status Indicator | Status as of April 2023 |

|---|---|

| Total Reserves Losses (April) | $25 Billion |

Strategic Approaches for Restoring Confidence and Stabilizing Turkey’s Economy

Navigating through political upheaval coupled with economic uncertainty requires that Turkey’s government implement strategic measures aimed at rebuilding investor confidence while addressing alarming reserve losses-specifically that $25 billion recorded last month. Immediate actions should focus on several key areas:

- Tightening Monetary Policy: A robust monetary policy prioritizing inflation control will be essential; adjustments by Central Bank might potentially be necessary to alleviate inflationary pressures.

- Pursuing Fiscal Duty:A commitment towards reducing public expenditure while enhancing revenue via strategic tax reforms can definitely help regain market trust.

- Cultivating Political Stability:A clear political landscape encouraging dialog among diverse factions will bolster investor confidence.

- Pursuing Foreign Investment Opportunities:Create favorable conditions for attracting foreign direct investments essential for economic recovery.

Additionally,regularly monitoring key economic indicators…, releasing updates publicly fosters clarity which builds public trust over time.Authorities must also prioritize creating conducive environments for local businesses by simplifying regulations while providing tailored support specifically towards small-medium enterprises (SMEs). Effectiveness can be tracked using performance metrics comparing pre-implementation versus post-implementation statuses:

Concluding Reflections on Turkey’s Economic SituationÂ

As Turkey confronts unparalleled economic challenges marked by a staggering $25 billion reserve loss last month-a pivotal moment indeed-the dual forces exerted by political turmoil alongside struggles faced by its currency compound existing difficulties confronting its economy today.With scrutiny now placed upon governmental capabilities navigating turbulent waters ahead-the implications stemming from these declines promise lasting effects felt throughout society moving forward into uncertain times ahead.

As critical decisions loom large shaping future trajectories-resilience exhibited within financial systems shall undergo rigorous testing whilst global observers keenly monitor developments unfolding across this landscape over coming months crucially determining pathways toward restoring stability amidst prevailing uncertainties.<|vq_15366|>

- Cultivating Political Stability:A clear political landscape encouraging dialog among diverse factions will bolster investor confidence.