The Inflation Dilemma in Zimbabwe: A Comprehensive Overview

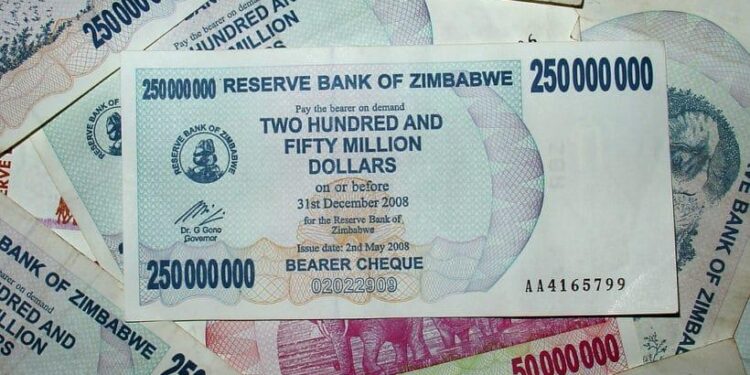

As of April 2023, Zimbabwe is entrenched in a profound economic crisis marked by staggering inflation rates. Reports from Reuters indicate that the annual inflation rate has soared to over 85%. This persistent inflationary trend underscores the ongoing struggles within the nation’s economy, fueled by fiscal mismanagement, currency instability, and external economic pressures. As households face skyrocketing prices and diminishing purchasing power, the consequences of this inflation are felt deeply across all aspects of life in Zimbabwe. This article delves into the root causes of this economic crisis, its impact on citizens’ daily lives, and government responses to these escalating issues.

Understanding Zimbabwe’s Inflation Trend

The recent surge in Zimbabwe’s inflation rate-exceeding an amazing 85% year-on-year as of April-has raised notable alarm among economists and residents alike.This relentless rise is not merely a statistic; it translates into tangible hardships for many families. Essential goods that were once affordable are now increasingly out of reach for numerous households. Despite various governmental attempts to implement monetary policies aimed at stabilizing the economy, public dissatisfaction is mounting as these measures have largely failed to yield positive results. The repercussions of rising prices are evident across multiple sectors as individuals grapple with substantial increases in costs while facing uncertainty about their financial futures.

The key drivers behind this inflationary trend include:

- Supply Chain Disruptions: Ongoing logistical challenges have delayed the timely delivery of goods to markets.

- Currencies Depreciating: The local currency continues its downward spiral against major international currencies.

- Market Speculation: Heightened speculation within markets has exacerbated price volatility, complicating recovery efforts further.

A detailed examination of monthly trends reveals just how critical the situation has become:

| Date | % Inflation Rate |

|---|---|

| January | 72% |

| February | 75% |

Impact on Daily Living and Economic Stability

The soaring inflation rate in Zimbabwe has profoundly impacted everyday life for its citizens, drastically altering their purchasing power and lifestyle choices. With annual inflation surpassing an alarming level exceeding85%, fundamental needs such as food security, housing affordability, and healthcare access have seen significant price hikes.Families now find themselves navigating tight budgets amidst dwindling resources;This shift compels them to prioritize spending differently than before.

Many households allocate nearly half their income towards essential items alone; some notable impacts include:

- Reduced Consumption: Households are limiting purchases strictly to necessary items only.

- Increased Bartering: Communities are reverting back towards barter systems due largely because instability surrounding currency value makes transactions tough.< / li >

- < b >Shift Towards Informal Markets :< / b >A growing number transactions occur outside formal sectors ,as residents turn increasingly toward local bazaars .< / li >

This rampant instability poses broader threats not only affecting individual livelihoods but also overall economic growth prospects . Businesses struggle under rising operational costs leading directly into increased unemployment rates alongside declining investments . Below summarizes key factors currently impacting Zimbabwe’s economy :

| Economic Factor | Description | A multitude companies downsizing or shutting down operations due high operational expenses .< / td >< tr >< td >Investment Decline | Lack foreign domestic investments becomes more prevalent amid increasing uncertainties surrounding market conditions .< / td >< tr >< td>Currencies Losing Value | The local currency continues depreciating against foreign currencies causing further complications within trade dynamics.< / td >

Strategies To Mitigate Currency Devaluation EffectsTo effectively address challenges stemming from significant devaluation stakeholders can adopt several strategies aimed at mitigating adverse impacts.Firstly ,it’s crucial hedge against potential losses through diversification investment portfolios.This may involve acquiring hard assets like real estate commodities which tend retain value better during periods marked by high levels volatility.Additionally engaging foreign exchange transactions helps protect finances both personal business interests alike from fluctuations associated with domestic currencies. Another viable strategy entails bolstering local production capabilities thereby reducing reliance imports adversely affected fluctuating exchange rates.This could encompass enhancing agricultural resilience boosting manufacturing capacities.Focusing on utilizing available resources locally minimizes costs stabilizes pricing structures.Meanwhile implementing financial literacy initiatives empowers citizens entrepreneurs make informed decisions regarding budgeting investing equipping them tools needed adapt prevailing circumstances. Final ThoughtsZimbabwe faces an ongoing battle against crippling levels exceeding 85% recorded annually since April.The implications extend far beyond mere statistics affecting both individuals businesses alike as depreciation persists undermining purchasing power overall financial stability.As policymakers navigate complexities arising out soaring inflations future remains uncertain.Analysts will closely monitor governmental responses potential strategies stabilize economies upcoming months serving reminder intricacies involved monetary policy necessity sustainable practices safeguard livelihoods populace. |

|---|