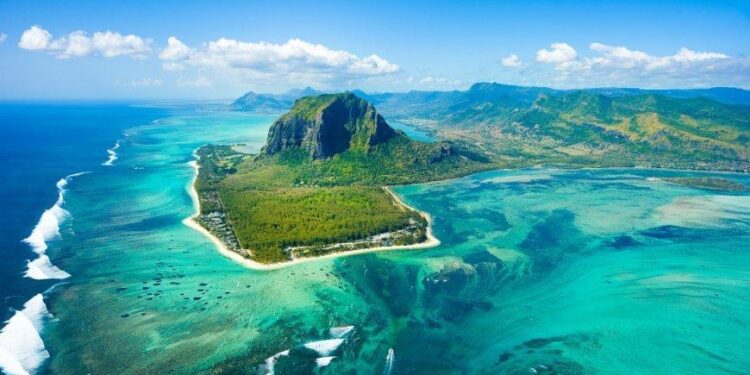

In a landmark development poised to reshape the financial landscape of the African continent, Mauritius has been selected to serve as the headquarters of Africa’s newly established credit ratings agency. This initiative represents a significant move to challenge the longstanding dominance of Western credit rating firms, which have historically held sway over the economic assessments of African nations. With the continent’s diverse economies increasingly seeking to assert their autonomy in financial matters, this agency aims to provide tailored ratings that reflect Africa’s unique market dynamics and growth potential. As the agency prepares to launch, its potential impact on investment, international perception, and economic policy across Africa calls for a closer examination of its goals, implications, and the broader context of global credit assessment practices.

Mauritius Emerges as a Strategic Hub for Africa’s Credit Ratings Agency

The decision to establish the headquarters of Africa’s new credit ratings agency in Mauritius marks a pivotal moment for the continent. This initiative aims to provide African nations with greater control over their financial assessments, diminishing the long-standing reliance on Western institutions. With a diverse economy, stable political environment, and strategic geographical location, Mauritius is poised to serve as a central hub, enhancing transparency and credibility in local and international markets. The new agency will empower African countries by offering ratings that reflect their unique economic contexts and challenges.

By positioning itself as a leader in credit ratings, Mauritius not only contributes to the continent’s financial independence but also incentivizes investments in emerging markets. This development fosters a range of benefits, including:

- Enhanced Financial Literacy: With localized ratings, countries can better understand their fiscal health.

- Increased Investment: A home-grown ratings agency is expected to boost investor confidence.

- Collaboration Opportunities: Countries can engage in data sharing and collective policy-making.

Furthermore, the anticipated agency will facilitate a more nuanced understanding of regional markets, allowing investors to make more informed decisions. The foundation of this new agency not only challenges the traditional credit rating landscape but also sets the stage for a more equitable and self-sufficient financial future across Africa.

Implications for Economic Sovereignty and Local Investment Strategies

The establishment of Africa’s new credit ratings agency in Mauritius signifies a pivotal shift in the continent’s economic landscape, especially concerning economic sovereignty. By reducing dependency on Western credit rating agencies, African nations can forge their own financial identities. This initiative underlines the necessity for local governments to prioritize home-grown investment strategies that resonate with regional economic realities. The growing sentiment is clear: African countries are increasingly taking control of their financial narratives, thus fostering an environment conducive to local entrepreneurship and development.

Furthermore, the agency’s presence is expected to catalyze local investment strategies that align more closely with the aspirations and needs of African economies. Stakeholders are urged to focus on:

- Investing in infrastructure that supports local industries.

- Promoting small and medium enterprises through tailored financial products.

- Enhancing public-private partnerships to leverage both local and foreign resources.

| Investment Focus | Expected Outcome |

|---|---|

| Infrastructure Development | Boost in local production capabilities |

| Support for SMEs | Job creation and innovation |

| Public-Private Partnerships | Increased investment inflow |

In embracing these strategies, African nations can better navigate their economic trajectories, ultimately leading to enhanced resilience against external financial pressures and a more robust growth framework.

Navigating the Challenges to Establish a Robust Ratings Framework in Africa

The establishment of a new credit ratings agency in Mauritius is a pivotal move aimed at reshaping the landscape of financial evaluation across Africa. While the initiative promises to enhance financial independence, it also faces considerable hurdles that must be navigated carefully. Key challenges include the need for transparent methodologies, the establishment of trustworthiness among investors, and the recruitment of highly skilled professionals to sustain the agency’s credibility and operational effectiveness. Moreover, there is a pressing need for the agency to ensure that it is perceived as independent from political influences, which could undermine its legitimacy.

Furthermore, collaboration among African nations is crucial for the agency’s success. Establishing a robust ratings framework requires harmonized efforts to address various issues, including regulatory discrepancies and market volatility. The following factors are essential for building a strong foundation:

- Standardization of Ratings Criteria: Developing uniform criteria that apply across different economies.

- Capacity Building: Investing in training programs for local analysts to ensure a high level of expertise.

- Stakeholder Engagement: Involving a broad range of stakeholders to gain insights and foster collaboration.

- Technology Utilization: Leveraging technology to enhance data collection and analysis capabilities.

Concluding Remarks

In conclusion, the establishment of Africa’s new credit ratings agency in Mauritius marks a significant milestone in the continent’s financial evolution. This move not only aims to provide a more localized perspective on creditworthiness but also seeks to challenge the long-standing dominance of Western rating agencies. By positioning itself at the forefront of this initiative, Mauritius not only enhances its role as a key player in Africa’s economic landscape but also empowers African nations to take control of their financial narratives. As the agency prepares to operate, the future implications for investment, economic policy, and African self-reliance are profound, heralding a new chapter in the continent’s journey toward financial independence and resilience. The world will surely be watching as this bold venture unfolds, with the potential to reshape the global financial framework in favor of African interests.