In a significant development for the oil and gas sector, Eni has unveiled a delayed timeline for the commencement of gas production at its offshore project in Libya, a key contributor to the region’s energy landscape. The declaration, reported by Upstream Online, highlights the complexities and challenges facing the ambitious project, which aims to bolster Libya’s domestic energy supply and enhance export capabilities. As Eni navigates the intricate dynamics of the Libyan market, industry stakeholders are closely monitoring the implications of this revised timeline for both the company’s strategic positioning and Libya’s broader economic recovery. This article delves into the details of the announcement, examines the factors influencing the delays, and considers the potential impact on Libya’s energy future.

Eni Adjusts Timeline for First Gas Production at Libya’s Offshore Project

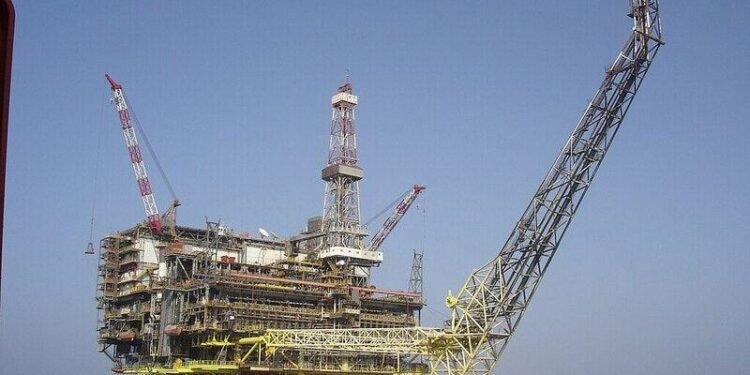

Eni has announced a revised schedule for the commencement of gas production at its offshore project in Libya, pushing the timeline later than initially anticipated. Industry analysts have noted that this delay can impact both market dynamics and Eni’s strategic positioning in the Mediterranean region. The project, which holds significant promise due to Libya’s vast hydrocarbon reserves, has faced several challenges, including political instability and logistical hurdles. Eni’s update highlights the complexities involved in offshore operations, especially in regions with fluctuating regulations and environmental considerations.

Despite the challenges, Eni remains committed to advancing the project, with plans now set for production to start in the following timeframe:

| Milestone | Revised Timeline |

|---|---|

| First Gas Production Start | Mid-2024 |

| Full Production Capacity Achieved | Late 2025 |

Energy stakeholders will be closely monitoring the progress of Eni’s offshore initiatives. The refined timeline not only reflects the operational challenges but also raises critical questions about investment strategies and potential partnerships in the region. As Libya continues to navigate its geopolitical landscape, Eni’s role could be pivotal in revitalizing its energy sector.

Analyzing the Implications of Delayed Gas Output on Libya’s Energy Sector

The announcement from Eni regarding a delayed timeline for gas output from its offshore project in Libya carries significant potential repercussions for the country’s energy landscape. As one of Africa’s leading oil producers,Libya’s energy sector is already fragile due to ongoing political instability and infrastructural challenges. Delays in gas production can lead to a domino effect, impacting not only national revenue but also foreign investments that are critical for the development of the sector. Key implications include:

- Revenue Shortfall: The postponement in gas output may lead to decreased national income from exports, straining the government’s budget and hindering public services.

- Investor Confidence: With uncertainties around project timelines, foreign investors may reconsider their commitments to Libya’s energy sector, fearing further delays.

- Domestic Energy Supply: A reduced output could exacerbate domestic energy shortages, limiting access for businesses and households.

Moreover, the ripple effects of delayed production also extend to global energy markets. As Libya struggles to maintain its gas output,other countries may fill the void,leading to shifts in supply chains and price adjustments. If the situation persists, it could further marginalize Libya in the competitive landscape of energy production. Consider the following potential market impacts:

| Impact | Potential Outcome |

|---|---|

| Global Gas Prices | Potential Increase Due to Reduced Supply |

| Trade Partnerships | Shifts in Buyer Preferences to More Reliable Suppliers |

| Market Competition | Heightened Competition Among Gas-exporting Countries |

Strategic Recommendations for Eni to Mitigate Future Project Delays

To enhance project efficiency and reduce the likelihood of future delays, Eni should consider implementing a proactive risk management framework that identifies potential bottlenecks early in the project lifecycle. This could involve the adoption of sophisticated predictive analytics tools that enable the company to assess risks associated with engineering, procurement, and construction activities. Additionally, strengthening communication channels with local stakeholders, including government agencies and contractors, can foster a collaborative environment that aids in swiftly addressing any unforeseen challenges. Key recommendations include:

- Establishing a dedicated task force to monitor and manage project timelines.

- Incorporating real-time data tracking systems to oversee project progress.

- Enhancing contractor selection processes to include a focus on proven track records in similar projects.

- Implementing regular training sessions for teams on agile project management methodologies.

Moreover, Eni could benefit from revising its supply chain strategies to ensure resiliency against external disruptions. This can involve diversifying suppliers to mitigate dependency on any single source and investing in local supply chains to decrease logistical complications. A streamlined procurement process, paired with strategic partnerships, may lead to quicker mobilization of resources, thereby maintaining project momentum. Considerations for improving procurement could include:

| Strategy | Description |

|---|---|

| Diverse Supplier Network | Engage multiple suppliers to secure critical materials and services. |

| Local Partnerships | Collaborate with local firms to enhance agility and responsiveness. |

| Inventory Optimization | Maintain strategic stock levels to buffer against supply chain interruptions. |

Final Thoughts

Eni’s announcement about the delayed timeline for the commencement of gas production from its offshore project in Libya underscores the complexities of energy exploration and development in the region. While the project holds significant promise for both Eni and Libya’s economy, the revised schedule points to the ongoing challenges the petroleum sector faces amid geopolitical uncertainties and operational hurdles.As stakeholders await further updates, the implications of this delay will be closely monitored, particularly in the context of global energy markets and Libya’s long-term economic stability.The full impact of this timeline shift will undoubtedly unfold in the months ahead, as Eni navigates the next steps in this crucial endeavor.