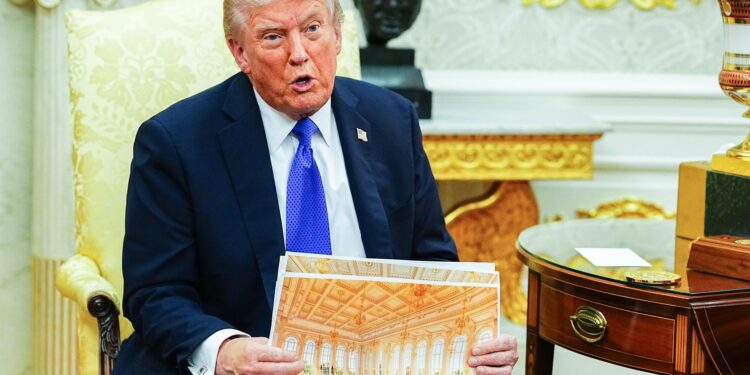

Impact of the 50% Tariff on Lesotho’s Denim Exports: Insights and Reactions

In a surprising turn of events that has disrupted the global trade environment, President Donald Trump has imposed a significant 50% tariff on denim exports from Lesotho, an essential manufacturing center for well-known American brands such as Levi’s and Calvin Klein. This decision emerges amidst ongoing negotiations regarding trade policies, raising concerns among economists and industry analysts about its potential effects on the textile industry and U.S.-Africa trade relations. With Lesotho’s economy heavily reliant on its apparel sector, this new tariff could lead to job losses locally while also affecting American consumers who have come to expect affordable denim options. This article delves into the consequences of this tariff, the reasoning behind this policy shift, and how various stakeholders are responding to these unexpected developments.

Impact of Trump’s Tariff on Lesotho’s Denim Industry and Global Supply Chains

The recent implementation of a hefty 50% tariff on denim exports from Lesotho is sending shockwaves through both its economy and international apparel supply chains. Major brands like Levi’s and Calvin Klein rely heavily on production in Lesotho; thus, this new tax threatens to significantly raise retail prices while potentially disrupting established market relationships. Local manufacturers are now facing soaring export costs that threaten their profitability-this situation may result in substantial job losses as well as diminished production capabilities.

The ramifications extend beyond Lesotho; global stakeholders are reevaluating their manufacturing strategies in response to these changes, creating broader uncertainties within textile supply chains worldwide. As companies seek alternative production locations to mitigate financial pressures caused by tariffs, they may redirect investments toward countries with more favorable trading conditions-this could lead to significant shifts across international logistics networks. Furthermore, consumers might face increased prices at retail outlets due to brands grappling with higher sourcing costs.

- Potential shifts in sourcing strategies

- Impacts on employment rates within Lesotho

- Long-term pricing effects for consumers

- Challenges faced by brands striving for competitive pricing

Financial Consequences for Levi’s and Calvin Klein: Adapting to New Market Realities

The introduction of a steep 50% tariff on denim sourced from Lesotho-a vital location for iconic labels like Levi’s and Calvin Klein-has sent ripples through the fashion sector. As these companies confront sudden cost escalations due to tariffs, they must reassess their supply chain dynamics along with pricing structures. The implications of this import duty could resonate throughout the entire market ecosystem affecting everything from consumer price frameworks to brand loyalty trends.

Eminent economists anticipate that these increased costs will likely be passed onto consumers; however, there is apprehension that brands might need to absorb some losses themselves if they wish to maintain competitiveness in an increasingly challenging marketplace.

To effectively navigate these challenges ahead, companies such as Levi’s and Calvin Klein may need consider diversifying their manufacturing bases through strategies including:

- Pursuing alternative production sites in countries with lower or no tariffs.

- Investing in automation technologies , which can help reduce overall production expenses.

- Cultivating direct-to-consumer sales channels , enhancing profit margins amidst rising operational costs.

A nimble response will be crucial for maintaining market presence amid shifting economic conditions; adapting swiftly not only ensures survival but also opens doors for new opportunities within an ever-evolving global marketplace.

Strategic Guidance for Denim Exporters Amid U.S. Tariff Changes

The recent enactment of a staggering 50% tariff impacting denim exports from Lesotho necessitates prompt action by exporters aiming to remain competitive within U.S markets. A primary focus should be placed uponDiversifying supply chains . By exploring other markets beyond reliance solely upon U.S., exporters can uncover opportunities emerging economies where demand continues growing robustly.

Forming partnerships with local manufacturers located outside affected regions can foster resilience against future export challenges.

Moreover, investing heavily into technology & innovation will streamline operations while simultaneously lowering overall production expenses providing necessary buffers against high tariffs imposed by governments around world .

< p >Additionally , exporters should prioritize product differentiation by emphasizing sustainability practices ethical labor standards unique designs appealing discerning customers who value quality over price alone . Engaging targeted marketing campaigns showcasing these attributes not only attracts environmentally conscious buyers but strengthens brand loyalty even under pressure created by fluctuating tariffs . Lastly , establishing buffer stock inventory United States prior anticipated price hikes allows strategic adjustments based changing economic landscapes ensuring continued success despite external pressures .< / p >