In a meaningful advancement for the global cocoa market, prices have surged in response to a slowdown in cocoa exports from the Ivory Coast, one of the world’s leading producers. As the West African nation grapples with logistical challenges and adverse weather conditions, concerns over supply shortages have led to a marked increase in cocoa prices on international exchanges. This article delves into the factors contributing to the current spike, the implications for cocoa farmers and consumers alike, and what this could mean for the future of the chocolate industry globally. With the Ivory Coast accounting for a considerable portion of the world’s cocoa production, the recent trends in export levels are poised to ripple through the market, affecting everything from chocolate costs to agricultural practices in the region.

Cocoa Supply Disruptions Impact Global Markets as Export Challenges Rise

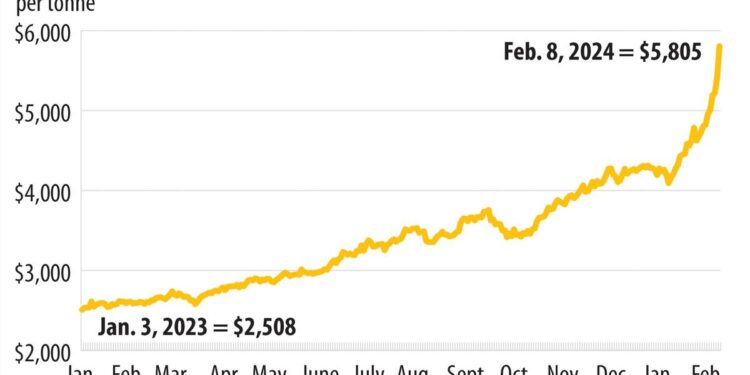

the recent slowdown in cocoa exports from the Ivory Coast has sent shockwaves through global markets, culminating in a significant surge in cocoa prices. This disruption is primarily attributed to poor weather conditions, which have affected harvests in one of the world’s largest cocoa-producing nations. Furthermore, logistical challenges such as transport delays and port congestion have exacerbated the situation, making it increasingly tough for farmers to deliver their goods to international markets. As a result, traders are scrambling to secure supplies, leading to heightened volatility in cocoa pricing.

Several factors are contributing to the rising cocoa prices, including:

- Increased global demand for chocolate products.

- Supply chain inefficiencies that are causing delays in distribution.

- Currency fluctuations affecting export revenues.

This perfect storm of export challenges is placing pressure on manufacturers and consumers alike, as they anticipate further disruptions in the cocoa supply chain. As the industry adapts to these changes, stakeholders are keeping a close watch on pricing trends and potential new policies that could arise in response to the ongoing crisis.

analysts Warn of Potential Price Volatility Amidst Ivory Coast Export Slowdown

As the cocoa market witnesses a marked increase in prices, analysts are cautiously observing the situation in the world’s largest cocoa producer, Ivory coast. Recent reports suggest that export volumes may take a significant hit due to a combination of climatic challenges, logistical hurdles, and increasing domestic consumption. This decline not only presents challenges for maintaining supply chains but also raises concerns over the stability of cocoa prices globally. Industry experts highlight the following factors contributing to this potential volatility:

- unfavorable Weather Conditions: Poor weather patterns have led to decreased yields.

- Infrastructure Limitations: Infrastructural deficiencies are slowing down export processes.

- Increased Local Demand: A surge in local processing may divert beans from traditional export channels.

With these issues at play, the market may experience erratic fluctuations in cocoa prices, particularly as buyers scramble to secure supplies. Ancient data reveals that previous downturns in export levels have frequently enough preceded sharp price jumps, leaving many stakeholders in the industry apprehensive. Below is a brief overview of cocoa price trends correlated with export changes in recent years:

| Year | Export Volume (metric tons) | Average Price ($/ton) |

|---|---|---|

| 2021 | 1,500,000 | 2,200 |

| 2022 | 1,200,000 | 2,500 |

| 2023 | 1,000,000 | 2,800 |

As surrounding developments unfold, stakeholders must remain vigilant, adapting to changing dynamics to mitigate risks associated with this potential price volatility. The cocoa market, while resilient, may face challenging times ahead, requiring strategic foresight from producers, buyers, and investors alike.

Recommendations for Stakeholders in the Cocoa Industry to Navigate Market Fluctuations

As cocoa prices experience volatility due to slowed exports from the Ivory Coast, stakeholders in the cocoa industry must adopt proactive strategies to mitigate risks. To navigate these market fluctuations effectively, it’s crucial for producers, traders, and investors to focus on the following strategies:

- Diversification: Stakeholders should consider diversifying their supply sources to reduce dependency on any single country, particularly those experiencing export slowdowns. Engaging with producers from other regions can also help stabilize supply.

- Market Intelligence: Continuous research and analysis of market trends, including price forecasts and demand shifts, can equip stakeholders with insights to make informed decisions and adjust pricing strategies accordingly.

- Financial Instruments: Utilizing hedging strategies or futures contracts can definitely help stabilize income and manage exposure to adverse price movements in the short term.

Additionally, building resilience within the supply chain can prove beneficial in times of sudden market changes. Stakeholders might consider:

- Strengthening Relationships with Farmers: establishing long-term contracts with farmers can ensure consistent supply and better price stability for producers.

- investing in Technology: Employing advanced farming techniques and technologies can enhance production efficiency, thereby reducing costs and increasing competitiveness in fluctuating markets.

- Capacity Building: Empowering farmers through training programs to improve yield and quality can have lasting positive impacts on supply stability.

Future Outlook

the recent surge in cocoa prices reflects the complex interplay of supply chain dynamics, particularly the slowdown of exports from the Ivory Coast, the world’s leading cocoa producer. As global demand for chocolate remains robust,the tight supply situation raises concerns among manufacturers and consumers alike. Stakeholders in the cocoa industry will need to navigate these developments carefully, as fluctuations in pricing could impact everything from the cost of chocolate products to the livelihoods of farmers. As the situation unfolds, it will be crucial to monitor how these market changes influence both local economies and global chocolate manufacturing. Continued analysis will shed light on the sustainability of production practices and the resilience of cocoa markets amid shifting conditions.