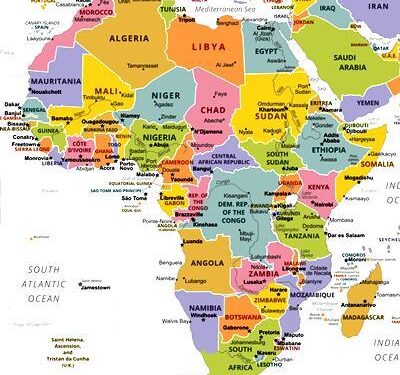

Emerging Potential of Ghana and Uganda Currencies in Global Financial Landscape

In a time marked by unpredictable global financial conditions, the currencies of Ghana and Uganda are beginning to exhibit signs that they may be on the brink of a notable recovery. A recent report from Reuters indicates that a combination of effective economic policies, increasing foreign investments, and improved political stability could enhance the value of both the Ghanaian cedi and Ugandan shilling against major international currencies. As these nations navigate complex local and global economic environments, investors are keenly observing developments that might signal an enhancement in their financial outlook. This expected resurgence not only aims to boost consumer confidence but also has potential ramifications for broader regional economic advancement.

Factors Contributing to Currency Strength in Ghana and Uganda

The currencies of these two countries have garnered attention due to their potential for appreciation amid shifting global market dynamics. Experts suggest that stable economic frameworks coupled with growing investor confidence could serve as pivotal factors driving this positive trend. The following elements significantly contribute to this optimistic perspective:

- Increasing Commodity Prices: Both nations are key producers of various commodities whose prices have recently risen sharply, providing support for their respective currencies.

- Proactive Government Policies: Ongoing reforms aimed at enhancing fiscal stability are likely to improve investor sentiment towards these economies.

- Sustained Remittance Flows: A consistent influx of remittances is anticipated to further strengthen local currency values by mitigating external pressures.

The changing dynamics within global markets-including alterations in trade relationships and shifts in monetary policies among developed countries-are also expected to influence how these African currencies perform. The table below summarizes recent currency fluctuations along with key factors affecting both Ghana’s cedi and Uganda’s shilling:

| Currency | % Change Recently | Main Influencing Factors |

|---|---|---|

| Cedi (GHS) | +1.5% | Sustained commodity price increases, remittance support |

Factors Influencing Currency Appreciation Across Africa

A multitude of interconnected elements appears poised to significantly impact currency appreciation across West and East Africa regions. Central among them issustained economic stability;a nation demonstrating sound fiscal management alongside low inflation rates tends to attract foreign investment, thereby increasing demand for its currency.

Additionally,a stable political habitat;a country recognized for transparent governance practices typically experiences less volatility regarding its currency valuation.

Another crucial aspect is the influence exerted bysupply prices;;for resource-rich nations like Ghana and Uganda, elevated prices on agricultural or mineral exports can enhance trade balances leading to stronger currency valuations.

The progress made throughbroad infrastructure development;widely integrated transportation networks combined with reliable energy systems can greatly elevate productivity levels making economies more appealing targets for international investors.

Monetary policy decisions enacted by central banks also carry important weight; strategic interest rate adjustments aimed at controlling inflation can stimulate capital inflows into these economies.

As trends evolve within local markets as well as globally,the interplay between these factors will be critical in shaping future trajectories for currencies across both nations.

| < strong >Drivers Behind Currency Strengthening< / strong > | < strong >Impact on Currency Valuation< / strong > < / tr > < / thead > |

|---|---|

| Economic Stability | Facilitates increased investment demand leading up valuation gains.< td /> |

| Reduces fluctuations while enhancing overall trustworthiness .< / td >< / tr > | |

| Strengthens trade balances resulting into improved valuations .< / td >< / tr > | |

| Boosts productivity making economy attractive.< / td >< / tr > | |

| Encourages capital influx through interest rate modifications .< / td >< / tr > |

Investment Strategies For Exploiting Potential Currency Gains In Africa

If you’re an investor looking to capitalize on possible gains from appreciating currencies within Ghana &Uganda ,consider adopting a diversified approach across various asset classes which helps mitigate risks associated with fluctuating exchange rates . Key strategies include :

- < strong >Forex Trading:< strong />Engaging actively within forex markets allows immediate profit opportunities arising from shifts between different pairs ; traders often utilize leverage accounts maximizing returns even off minor price variations .< li />

- < strong >Local Stock Markets:< strong />Investing directly into shares belonging companies benefiting from strengthening domestic currencies leads not just towards capital growth but dividends especially prevalent amongst export-oriented sectors.< li />

- < strong>Bonds Investments:< strong />Acquiring government bonds denominated locally may yield attractive returns particularly if central banks opt raising interest rates responding positively towards appreciating national assets.< li />

Additonally , staying updated regarding pertinent local indicators alongside geopolitical events influencing exchange rates remains essential ; complementing such activities via hedging techniques further safeguards investments against adverse fluctuations occurring unexpectedly ! Consider incorporating following aspects when crafting balanced portfolio :

| Investment Type | Potential Returns | Risk Level |

|---|---|---|

< Future Outlook/h3 >

The future prospects surrounding Ghanas’and Ugandas’currencies reflect intricate interactions involving regional economics alongwith prevailing global market trends.As each nation tackles challenges posed through inflationary pressures coupled with shifting fiscal policies there exists optimism suggesting strategic adjustments combined together w/ renewed investor confidence could strengthen respective national assets over time.A close watch over emerging indicators plus geopolitical developments will prove vital stakeholders seeking capitalize upon forthcoming opportunities! As financial landscapes evolve continuously so too do prospects surrounding Ghanas’&Uganadas’currencies promising intriguing narratives awaiting exploration by policymakers/investors alike!