In a significant shift in international economic relations, the United States is poised to invest billions of dollars in the mineral-rich Democratic Republic of the Congo (DRC) following the imposition of tariffs that have reshaped global trade dynamics. This strategic move signals a renewed focus on securing vital resources essential for technological advancements, notably in the clean energy sector. The initiative aims to bolster U.S. investment in partnerships with Congolese industries, fostering not only economic growth in the region but also enhancing supply chain resilience amid ongoing geopolitical tensions. As the U.S. seeks to establish more reliable access to critical minerals, experts are closely examining the implications of this investment on both countries as well as the broader global market.

US Strategic Shift: Leveraging Tariff Changes to Boost Mineral Investment in Congo

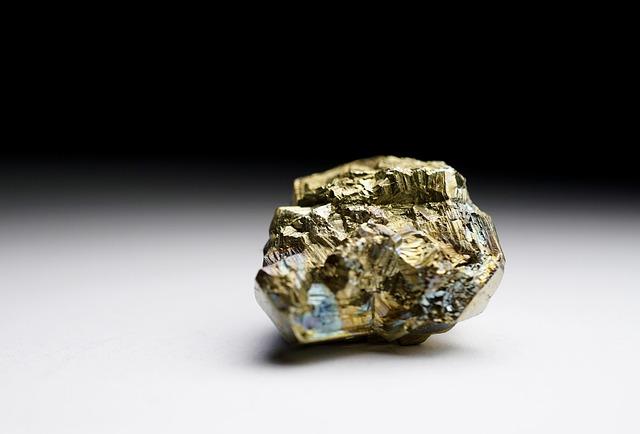

In a bold move that signals a strategic pivot in U.S. economic policy, the recent tariff adjustments have generated significant interest in mineral investments within the Democratic Republic of Congo (DRC). The U.S. government aims to capitalize on the DRC’s vast mineral wealth, particularly cobalt and lithium, essential for modern technologies such as electric vehicles and renewable energy systems. The potential influx of American capital could provide much-needed infrastructure improvements and economic stability in a nation characterized by political volatility and poverty.

Several factors contribute to this renewed interest in Congolese minerals. The U.S.management has identified the need to reduce reliance on foreign mineral sources, particularly from geopolitical rivals. By fostering local partnerships and engaging with the Congolese government, potential investors are eyeing opportunities that could yield lucrative returns while also aiding in the development of lasting mining practices. Key incentives include:

- Tax breaks for U.S. companies investing in Congolese mining operations.

- Infrastructure support, including roads and power sources, to facilitate efficient mining processes.

- Environmentally sustainable practices encouraged by U.S.standards.

This surge in investment interest is already being reflected in financial commitments, with projected billions aimed specifically at fostering mining initiatives in the region. As the U.S. positions itself as a leader in the global supply chain for critical minerals, the DRC stands at the forefront of this new economic landscape, promising significant opportunities for both American investors and local communities.

Economic Implications: Understanding the Potential Impact on Local Communities and Global Markets

The recent announcement of significant U.S. investment in Congo’s mineral sectors comes laden with profound economic implications, not just for local communities but also for global markets. As the U.S. aims to secure stable and ethical supply chains for critical minerals, this financial commitment could offer a lifeline to impoverished communities in Congo, fostering job creation and infrastructure development. Though, the anticipated influx of foreign capital may alter the balance of power within local economies, possibly leading to a dependency on external funds and market volatility.

Moreover, this investment is likely to reverberate through global markets, particularly in the tech and renewable energy sectors. The U.S.’s proactive approach to securing mineral resources essential for batteries and microchips may drive competition among other nations,shaping a new era of geopolitical dynamics.Stakeholders must remain vigilant, as fluctuations in mineral prices could trigger cascading effects across industries, influencing everything from manufacturing costs to consumer prices.

Recommendations for Sustainable Growth: Ensuring Responsible practices in Congo’s Mineral Sector

As the United States explores the potential of investing billions in the mineral-rich Democratic Republic of the Congo,ensuring that this influx of capital fosters sustainable growth is critical. Responsible practices must take center stage to prevent environmental degradation and social destabilization. To achieve this, several strategies shoudl be prioritized:

- Enhancing transparency: Implementing clear regulations and oversight to improve accountability in the sector.

- Empowering Local Communities: Ensuring that local populations benefit from mineral wealth through fair compensation and job creation.

- Promoting Sustainable Mining Techniques: Encouraging practices that minimize environmental impact and prioritize the restoration of mined land.

Moreover, collaboration between the Congolese government, international investors, and non-governmental organizations is paramount. By fostering partnerships that emphasize ethical sourcing and social duty,stakeholders can leverage the country’s vast mineral resources while also promoting stability and growth.Here is a summary of key objectives for investment in the DRC’s mineral sector:

| Objective | Description |

|---|---|

| Social Responsibility | Ensure that benefits from mining activities are shared with affected communities. |

| Environmental Stewardship | adopt practices that protect the local ecosystems and biodiversity. |

| Economic diversification | Invest in other sectors to reduce dependence on mining revenues. |

Final Thoughts

the U.S. government’s strategic pivot towards mineral investment in the Democratic Republic of congo underscores an evolving approach amid global trade tensions. As Washington attempts to strengthen ties with the mineral-rich nation, the promise of billions in investment not only highlights the importance of Congolese resources but also reflects a broader geopolitical strategy to ensure access to critical minerals in a competitive landscape. The implications of this renewed engagement could resonate far beyond economic interests, potentially reshaping alliances and influencing the future of mineral supply chains. As stakeholders on both sides navigate the complexities of this relationship, the coming months will likely reveal how thes commitments translate into tangible partnerships and commitments on the ground.